Many years ago I was watching a news show about how to eat healthy on Thanksgiving in which three sets of guests gave advice. The first suggested low fat alternatives to staples such as sweet potatoes and stuffing which seemed like little more than flavored sawdust. The second one also suggested alternatives (albeit somewhat more palatable), using smaller plates and my first introduction to the term Tofurkey®.

Many years ago I was watching a news show about how to eat healthy on Thanksgiving in which three sets of guests gave advice. The first suggested low fat alternatives to staples such as sweet potatoes and stuffing which seemed like little more than flavored sawdust. The second one also suggested alternatives (albeit somewhat more palatable), using smaller plates and my first introduction to the term Tofurkey®.

Suddenly I was not looking forward to Thanksgiving.

Fortunately the last guests, a husband/wife fitness team gave some great advice. It's Thanksgiving. It only comes around once a year so treat yourself, just don't go nuts. Have a little of each instead of overloading your normal-sized plate. Have the sweet potatoes with melted marshmallows, sausage dressing, mashed potatoes with butter, grandma's homemade biscuits, roasted turkey covered with gravy followed by hot pecan pie. I liked the last guests the best.

From all of us at Big "I" Markets, have a blessed, happy, and safe Thanksgiving, but from me, don't be afraid to ease up a little on the healthy for one day.

(BTW - The mayor of Seattle just pardoned a Tofurkey.)

_______________________________________

Management Liability & the Patient Protection and Affordable Care Act

A WEBINAR PRESENTED THROUGH TRAVELERS

This presentation will:

-

Provide an Overview of the Patient Protection and Affordable Care Act ("PPACA")

-

Explain Employer PPACA Obligations

-

Discuss New Exposures

-

Discuss Employer Responses to PPACA

-

Outline New PPACA Risk Management Tools from Travelers Bond & Financial Products Provide Overview of New Fiduciary Liability Policy Endorsements

Date: December 3rd

Duration: 1 hour

Time: 2 p.m. Eastern

Presented by:

James P. Anelli, LeClairRyan

James P. Anelli has for more than twenty years focused his practice on the representation of management in employment discrimination and labor litigation, including representing management in grievances, arbitrations and unfair labor practices. He leads the firm's newly created Affordable Care Act team, which focuses on helping employers of all types and sizes successfully implement changes currently and soon-to-be required by the nation's unprecedented healthcare reform initiatives. Mr. Anelli regularly provides counsel to corporate clients regarding compliance with state and federal employment requirements and designing effective personnel policies, and the development, design and implementation of employee benefit programs.

Once registration is complete, you will receive an electronic confirmation and reminders prior to the webinar. If you experience difficulty with registering, please call 651.310.7236. If you experience difficulty when attempting to join the webinar, please call 888.259.8414 for online or audio problems

REGISTER NOW!

+++++

Time Management for the Insurance Professional - The 7 Maxims of Time Management

December 10, 2014

2:00 to 3:00 p.m. Eastern Time

Click here to register.

According to a composite of several time management studies, the average worker "wastes" about 1-1/2 hours per day...47 days (over 1-1/2 months) per year. According to several national studies, employees CAN increase their productivity by 15% to 105% simply through the development of effective personal management skills such as goal setting, planning, prioritizing, scheduling, and eliminating "time wasters."

From the agency's standpoint, improving productivity by 20% can TRIPLE before-tax profits (assuming that payroll is just 50% of commissions and return on sales is just 5%). By employing the principles outlined in this program and putting the techniques into practice, you can dramatically impact your bottom line while reducing the stress and anxiety of your staff. To accomplish this mission, here are Seven Simple Steps to gaining control of your time.

This FREE one-hour webinar presents the big picture, based on a 7-step process, on how to begin to get control of your time and your business and personal lives.

+++++

Remember that you can view the following webinars 24/7 by checking out the BIM Webinar Library. To do that log onto Big "I" Markets and click on "Publications".

- Personal Liability Trends - Fireman's Fund

- TravPay

- Commercial Lessor's Risk

- Affluent Homeowners

- Travelers Select Products (series)

- Travel Insurance

- Community Banks

- XS Flood

- Real Estate E&O

- RLI Personal Umbrella

- Affluent Homeowner

- "Oh, by the way...Flood Sale"

- Habitational

- Non-standard Homeowner

- Student Housing

+++++

"OH BY THE WAY...FLOOD SALE" WEBINAR

Interested in learning flood marketing techniques? Participate in the "Oh, By the Way...Flood Sale" webinar presented by Big "I" Flood Program Manager, Jeff St. John. Topics in the fast-paced 1 hour presentation include: Reasons to Sell Flood Insurance • Reasons Consumers Should Buy • Limited Product Knowledge • Misconceptions by Agents & Consumers • Talking Points & Myth Busters • The Flood Risk • Flood Resources – Facts & Statistics.

Webinar dates:

The webinar for Wednesday, December 3rd has been cancelled.

+++++

BIM WEBSITE TRAINING WEBINAR

For all you folks who recently registered for Big "I" Markets, remember you can participate in a webinar from the comfort of your office to help you learn how to navigate around the system. Every Thursday at 2:00 p.m. EST we'll show you how to navigate the Big "I" Markets platform, including how to submit a quote! Register for the webinar by sending an email with your name and company name to bigimarkets@iiaba.net. Include "Website Navigation Webinar" in the subject line or body of your email. A recording of this webinar can be found under "Publications" after logging into Big "I" Markets.

There will be no Training Webinar on Thursday, November 27th.

________________________________________

Don't Forget Renters Insurance!

By Paul Buse, President of Big I Advantage

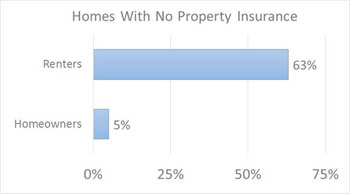

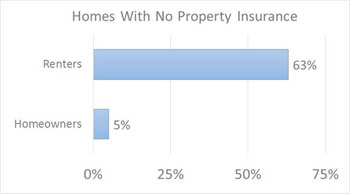

In 2013, $80 billion was spent on P&C premiums for insurance on homes and personal property. That's over 15% of the premiums in the P&C industry. What those figures do not convey -- however impressive they are -- is the degree to which renting occupiers are uninsured. As you can see below, while nearly every home that is owned is insured, only one in three renters have coverage. That's right, two-thirds of renters have no personal liability, no personal property and no loss of use coverage. With the Insurance Information Institute surveys showing renters insurance costing less than $200 per year (about 1/5 of the average homeowners policy), clearly it's an offer of coverage than could be made more often.

Big "I" Markets Agents Please Take Note: Renters insurance is available on a one-off basis via Eagle Express New Business with MetLife. Each account is individually underwritten but coverage is generally available. Make the offer and document your files.

Click Graph for larger version

Click Graph for larger version

________________________________________

Here are the top three items that got BIM agents clicking from our last edition... see what you missed!

- Top Hiring Mistakes

- Pickle Ball

- All-In Condominium Coverage

________________________________________

On November 7th a district judge approved the plan to save the Detroit Institute of Art's priceless collection from the bankrupt city's creditors with a unique "Grand Bargain". The Institute will contribute $100MM and outside contributors will put up in excess of $700MM (including 10MM each from Ford & GM, $6MM from Chrysler and even $1MM from Toyota) to shore up Detroit's pension fund. In exchange control of the collection will be transferred to an independent charitable trust.

On November 7th a district judge approved the plan to save the Detroit Institute of Art's priceless collection from the bankrupt city's creditors with a unique "Grand Bargain". The Institute will contribute $100MM and outside contributors will put up in excess of $700MM (including 10MM each from Ford & GM, $6MM from Chrysler and even $1MM from Toyota) to shore up Detroit's pension fund. In exchange control of the collection will be transferred to an independent charitable trust. While wealthy private collectors probably don't have a trove as varied and extensive as the DIA they can still be faced with scores or hundreds of pieces. Chubb has developed a couple of ways to help your affluent clients manage virtually every aspect of their collection.

While wealthy private collectors probably don't have a trove as varied and extensive as the DIA they can still be faced with scores or hundreds of pieces. Chubb has developed a couple of ways to help your affluent clients manage virtually every aspect of their collection. December 10, 2014

December 10, 2014 Many years ago I was watching a news show about how to eat healthy on Thanksgiving in which three sets of guests gave advice. The first suggested low fat alternatives to staples such as sweet potatoes and stuffing which seemed like little more than flavored sawdust. The second one also suggested alternatives (albeit somewhat more palatable), using smaller plates and my first introduction to the term Tofurkey®.

Many years ago I was watching a news show about how to eat healthy on Thanksgiving in which three sets of guests gave advice. The first suggested low fat alternatives to staples such as sweet potatoes and stuffing which seemed like little more than flavored sawdust. The second one also suggested alternatives (albeit somewhat more palatable), using smaller plates and my first introduction to the term Tofurkey®.