The ACE Travel AppSM is a cutting-edge travel tool developed specifically for U.S.-based businesses and non-profit organizations with employees or volunteers traveling and conducting business overseas. Offered through ACE's Executive Assistance® Services, the mobile application provides ACE International Advantage® customers with information essential to the planning of any international trip. By consolidating information and function into one state-of-the-art technology app, users can receive travel information when and where they need it most.

The ACE Travel AppSM is a cutting-edge travel tool developed specifically for U.S.-based businesses and non-profit organizations with employees or volunteers traveling and conducting business overseas. Offered through ACE's Executive Assistance® Services, the mobile application provides ACE International Advantage® customers with information essential to the planning of any international trip. By consolidating information and function into one state-of-the-art technology app, users can receive travel information when and where they need it most.

ACE Travel App Services

When connected to a mobile network, some of the available services include:

-

Country Research

-

Travel Alerts

-

Security Services

-

Emergency Assistance

-

Concierge Services

ACE Travel App Benefits

-

ACE Travel App operates on all major devices

-

Call me back feature

-

An alternative to outdated and expired wallet cards

-

Receive real time alerts that are relevant to your travel plans

-

Quality aggregation of the country information

-

Traveler can filter the alerts to meet their needs

-

Mapping of hospitals and embassies

-

Seamless integration between web and mobile devices; enter travel information once

The ACE Commercial Risk Services' International Advantage Package Policy is the ideal insurance solution for U.S.-based companies doing business overseas. This single, easy-to-read property & liability policy can be tailored to include some or all of the coverages listed below, and protects against the many financial and personal risks confronting organizations with operations outside our nation's borders. With offices staffed by underwriting and claims professionals thoroughly familiar with local languages, pertinent regulations and customs their focus is exclusively on international business while providing superior customer service.

Coverage:

-

Commercial General Liability

-

Employers Responsibility with Executive Assistance® Services

-

ACE Travel AppSM

-

Automatic Emergency Medical Evacuation/Repatriation

-

Automatic Political Evacuation/Relocation

-

Foreign Voluntary Compensation

-

Contingent Employers Liability

-

Contingent Auto Liability

-

Kidnap & Extortion

-

International AD&D and Medical - Employee

-

International AD&D and Medical - Student and Chaperone

-

Commercial Property and Time Element

There are nearly 5,000 degree granting institutions in the United States with over 300,000 students studying abroad each year. The ACE Educators International Advantage® Edge is an exclusive foreign package policy that is comprised of comprehensive coverage enhancements specifically tailored to educators.

To access this product visit www.bigimarkets.com and select International Advantage from the commercial products menu.

_______________________________________

Disaster Recovery Webinar

Have you taken a look at IIABA's endorsed provider of disaster recovery services, Agility Recovery?

This Thursday, April 16th, 2015 from 2:00 PM to 2:30 PM EDT join Agility for "Business Preparedness: The Agility Story."

Learn how to minimize potential business interruption losses and how to implement an effective disaster recovery plan through the use of Agility's unique ReadySuite solution.

Bob Boyd, Agility's President & CEO will detail the turn-key ReadySuite solution that provides your organization access to the four key elements of recovery following a business interruption:

-

1. Office space complete with desks, chairs, bathrooms and standard office equipment.

-

2. Power for your office.

-

3. Communications: Telephone and Internet access.

-

4. Computer systems: Computers, servers, printers, fax, etc.

Register today for this complimentary webinar

+++++

The ISO CGL Property Damage Exclusions

May 6, 2015; 1:00 to 4:00 p.m. Eastern Time

$79 - Click here to register

The purpose of this webinar is to provide information about a very important element of coverage critical to building service providers, contractors, insurance agents, claims adjusters and subrogation units.

At the conclusion, participants should be able to: understand the primary purposes of CGL PD coverage and exclusions; understand the grant of coverage found in the language of these exclusions; understand the distinctions between ongoing vs. completed operations within the context of the exclusionary language; understand the historical significance and current application of "broad form property damage" and better serve insurance purchasers, particularly in the service and construction industries. VU webinar questions can be sent to bestpractices@iiaba.net.

+++++

Remember that you can view the following webinars 24/7 by checking out the BIM Webinar Library. To do that log onto Big "I" Markets and click on "Publications".

- Personal Liability Trends - Fireman's Fund

- TravPay

- Commercial Lessor's Risk

- Affluent Homeowners

- Travelers Select Products (series)

- Travel Insurance

- Community Banks

- XS Flood

- Real Estate E&O

- RLI Personal Umbrella

- Affluent Homeowner

- "Oh, by the way...Flood Sale"

- Habitational

- Non-standard Homeowner

- Student Housing

+++++

BIM WEBSITE TRAINING WEBINAR

We Have A PUP Contest Winner

The Burns Agency Approached 20%

By Paul Buse, President of Big I Advantage

We have a winner of our Maui Jim Sunglasses gift certificate! Wendy Lawlor of The Burns Agency in Clinton, New York: "Think Snow!" The agency is near Utica, Rome and Oneida, New York and not far from one of the nation's oldest liberal arts colleges, Hamilton College. The agency is a great example of what it means to be Trusted Choice® with the logo and Pledge of Performance prominently displayed on their website. They are also active with the Big "I" endorsed RLI personal umbrella program, which agents often use when a customer's HO carrier won't write the umbrella or offer a competitive rate.

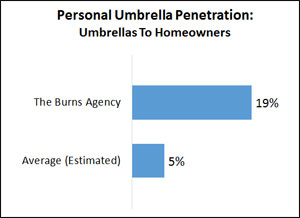

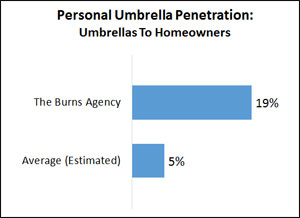

Wendy submitted the agency's figure for personal umbrellas and an impressive figure it is. The Burns Agency writes an umbrella for nearly one in five homeowners insureds. As you can see below, we think that is a "high water mark" for any agency to strive for and approaching FOUR TIMES what we think is "typical."

Click Graph for larger version

Click Graph for larger version

Entering the contest we were not sure of the best measure of personal umbrella penetrations but coming out of the contest we have settled on the number of personal umbrella policies per homeowners policies. It's easy to relate and compare. Industry rate filings and our own books of business in Big "I" Markets lead us to believe the average is about one umbrella for every 20 homeowners.

What does The Burns Agency do to obtain this penetration? The common thread is "awareness." Wendy relayed to us a ready list of reasons everyone should carry an umbrella and she shared those with us. We look to use those in our marketing of the Big "I" Endorsed RLI Personal Umbrella program with our Big "I" state associations. Also,

asking for the sale is key to getting the sale. My colleagues and I were surprised to reflect on the fact that none of us were ever asked by our agents whether we wanted an umbrella. Several of my colleagues remarked that they had to ask for their umbrella. Would your clients say the same?

On a final note, growing in importance in sales success is an idea everyone needs to avail themselves of: add-on Uninsured and Underinsured Motorist (UM/UIM) to the umbrella. RLI offers this. We discussed the possibility of using e-signatures and DocuSign to routinely document an insured or prospect's declination of the umbrella and that would include the declination of excess UM/UIM. :

Here are the top three items that got BIM agents clicking from our last edition... see what you missed!

Getting clients to think about comparing things other than coverage limits and price is difficult. Even when it seems like they are taking everything into account, you often are not sure that they even "get it." Since making the intangible tangible is what we do all the time, we offer two checklists to help your potential clients see the value of your MiddleOak proposal more than ever before.

Getting clients to think about comparing things other than coverage limits and price is difficult. Even when it seems like they are taking everything into account, you often are not sure that they even "get it." Since making the intangible tangible is what we do all the time, we offer two checklists to help your potential clients see the value of your MiddleOak proposal more than ever before. Have you taken a look at IIABA's endorsed provider of disaster recovery services, Agility Recovery?

Have you taken a look at IIABA's endorsed provider of disaster recovery services, Agility Recovery? The ACE Travel AppSM is a cutting-edge travel tool developed specifically for U.S.-based businesses and non-profit organizations with employees or volunteers traveling and conducting business overseas. Offered through ACE's Executive Assistance® Services, the mobile application provides ACE International Advantage® customers with information essential to the planning of any international trip. By consolidating information and function into one state-of-the-art technology app, users can receive travel information when and where they need it most.

The ACE Travel AppSM is a cutting-edge travel tool developed specifically for U.S.-based businesses and non-profit organizations with employees or volunteers traveling and conducting business overseas. Offered through ACE's Executive Assistance® Services, the mobile application provides ACE International Advantage® customers with information essential to the planning of any international trip. By consolidating information and function into one state-of-the-art technology app, users can receive travel information when and where they need it most.