As the summer wanes, so do airfares. For airlines their summer ends around August 15th as vacationers begin preparing for the school year, which actually began yesterday in many school districts around the country. For those domestic travelers who want to take advantage of those rates now is the perfect time. The temperature is still hot but not stifling and the crowds at popular tourist areas and amusement parks will likely be smaller, which means shorter lines for roller coasters and other attractions.

As the summer wanes, so do airfares. For airlines their summer ends around August 15th as vacationers begin preparing for the school year, which actually began yesterday in many school districts around the country. For those domestic travelers who want to take advantage of those rates now is the perfect time. The temperature is still hot but not stifling and the crowds at popular tourist areas and amusement parks will likely be smaller, which means shorter lines for roller coasters and other attractions.

Travel writers suggest flying off-peak, but then again, so does common sense. Another tip travel writers offer that too few people are aware of is travel insurance. (Know before you go.) Travel Insured International offers tips through their travel blog to help sell your client on the need for Travel Insurance through Big "I" Markets:

-

Review the product guide and comparison chart with your client.

-

When you are ready for coverage to be issued, click on "Request a Quote" in Big "I" Markets and provide the necessary information. A credit card will be required to issue coverage.

-

Coverage will be issued and confirmed in Big "I" Markets, and is currently available to members in all states.

To learn more travel over to

www.bigimarkets.com.

_______________________________________

"Beyond the Basics: Emerging Personal Lines Issues"

August 26, 2015

1:00 to 4:00 p.m. Eastern Time

$79 - Click here to register

This VU webinar examines a number of critical policy form changes that agents must know and communicate to the consuming public. The first hour focuses on ISO's planned new Personal Auto Program and a major change in their homeowners program. The second hour examines emerging issues, including car and home sharing, hydraulic fracking, and often misunderstood exposures and coverage gaps in ISO's homeowners program involving vehicles of various types. The third hour is devoted to two major auto exposures - family member vehicles and rental cars - and to insuring vacation risks such as motor homes, cruise ships, and overseas travel. Approved for CE in MD, MI, MT, NC, ND, NY, OH, OK, WA with AR, LA and NJ pending. See registration page for details.

Also planned is Certificates of Insurance - 2015 Edition. VU webinar questions can be sent to bestpractices@iiaba.net.

+++++

Remember that you can view the following webinars 24/7 by checking out the BIM Webinar Library. To do that log onto Big "I" Markets and click on "Publications".

- Personal Liability Trends - Fireman's Fund

- TravPay

- Commercial Lessor's Risk

- Affluent Homeowners

- Travelers Select Products (series)

- Travel Insurance

- Community Banks

- XS Flood

- Real Estate E&O

- RLI Personal Umbrella

- Affluent Homeowner

- "Oh, by the way...Flood Sale"

- Habitational

- Non-standard Homeowner

- Student Housing

+++++

BIM WEBSITE TRAINING WEBINAR

For all you folks who recently registered for Big "I" Markets, remember you can participate in a webinar from the comfort of your office to help you learn how to navigate around the system. Every Thursday at 2:00 p.m. EDT we'll show you how to navigate the Big "I" Markets platform, including how to submit a quote! A recording of this webinar can be found under "Publications" after logging into Big "I" Markets.

________________________________________

El Niño and Insured Catastrophes in USA

By Paul Buse, President of Big I Advantage®

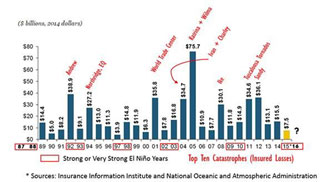

Last week it was widely reported in the news that the coming El Niño could be a record. As students of the industry we ask, "what does that mean for weather in the U.S. again?" Or, more specifically, what might it mean for the insurance industry? Munich Re tells us generally what you'll find (LINK: Go to Page 17). The big ones for insurance are that 2015-2016 should see fewer hurricanes in east, heavy rains/mudslides in California but also reduced winter tornado outbreaks over south-central U.S. with some tornados shifting south to Florida…so, some positives and negatives. But, as students, also know correlation is not necessarily causation. That is, while the sidewalk may be wet do not conclude it rained (it could have been a lawn sprinkler). With that caution, it is thought-provoking to chart the data from the Insurance Information Institute on insured catastrophes with data on strong El Niño years.

Click Graph for larger version

Source: Insurance Information Institute and National Oceanic and Atmospheric Administration

Click Graph for larger version

Source: Insurance Information Institute and National Oceanic and Atmospheric Administration

________________________________________

Here are the top three items that got BIM agents clicking from our last edition... see what you missed!

-

Certificates of Insurance - 2015 Edition

-

Travelers WC Price Reduction chart for 37 states

-

Tennessee Healthclub sued over Legionaires Disease

________________________________________

According to the U.S. Coast Guard, there are close to 12 million registered recreational boats in the United States. With so many boaters enjoying the waterways, it is no surprise that more than 4,000 boating accidents, involving more than 5,300 vessels, were reported in 20141, with far more that go unreported. Property damage reported in 2014 totaled approximately $39 million. Although these statistics represent little change from 2013, the fatality rate showed an increase of close to 9%.

According to the U.S. Coast Guard, there are close to 12 million registered recreational boats in the United States. With so many boaters enjoying the waterways, it is no surprise that more than 4,000 boating accidents, involving more than 5,300 vessels, were reported in 20141, with far more that go unreported. Property damage reported in 2014 totaled approximately $39 million. Although these statistics represent little change from 2013, the fatality rate showed an increase of close to 9%. When it comes to your flood carrier, it's a bright idea to choose Selective. Selective makes writing flood insurance easy through quality customer service and superior technology. Together, Big "I" Flood and Selective deliver members an unparalleled flood program. But how do you get started with Big "I" Flood? Just point, click, and roll!

When it comes to your flood carrier, it's a bright idea to choose Selective. Selective makes writing flood insurance easy through quality customer service and superior technology. Together, Big "I" Flood and Selective deliver members an unparalleled flood program. But how do you get started with Big "I" Flood? Just point, click, and roll! As the summer wanes, so do airfares. For airlines their summer ends around August 15th as vacationers begin preparing for the school year, which actually began yesterday in many school districts around the country. For those domestic travelers who want to take advantage of those rates now is the perfect time. The temperature is still hot but not stifling and the crowds at popular tourist areas and amusement parks will likely be smaller, which means shorter lines for roller coasters and other attractions.

As the summer wanes, so do airfares. For airlines their summer ends around August 15th as vacationers begin preparing for the school year, which actually began yesterday in many school districts around the country. For those domestic travelers who want to take advantage of those rates now is the perfect time. The temperature is still hot but not stifling and the crowds at popular tourist areas and amusement parks will likely be smaller, which means shorter lines for roller coasters and other attractions.