Last weekend I realized that I had been working way too hard when all I could see were the multiple risks and exposures every time I saw a commercial for all the classic Christmas movies. Right off, every time Santa landed on roof, I thought of hooves damaging shingles, wondered if the roof is reinforced to hold the weight and speaking of weight, chimney damage if the trip down is a little tight. Then there are expensive rugs damaged by sooty footprints. What if Santa had his primary residence in the US instead of the North Pole, did you know he could get the reindeer covered under the Affluent program?

Last weekend I realized that I had been working way too hard when all I could see were the multiple risks and exposures every time I saw a commercial for all the classic Christmas movies. Right off, every time Santa landed on roof, I thought of hooves damaging shingles, wondered if the roof is reinforced to hold the weight and speaking of weight, chimney damage if the trip down is a little tight. Then there are expensive rugs damaged by sooty footprints. What if Santa had his primary residence in the US instead of the North Pole, did you know he could get the reindeer covered under the Affluent program?

In the movie Scrooged, the title character runs a television studio, so what if Santa's sleigh clipped the broadcast tower? This made me think, what other kinds of coverage would Ebenezer Scrooge need that Big "I" Markets could provide?

A Christmas Carol

In the original story Charles Dickens just describes Scrooge as "a man of business" but there are multiple versions that have portrayed his occupation such as banker, middleman, importer (Fezziwig was a tea importer), retailer, and landlord, among others. He may have been all of these things.

That means that depending on the movie he needed: Workers Comp, Master Pac (Office, Building, Store, etc.), Community Banks, Bonds (Surety at the least), EPLI, Flood, habitational (Travelers Select or MiddleOak), Real Estate Agents E&O, Non-standard Rental Dwelling International Advantage, & Property Manager E&O. When the three ghosts took Ebenezer from his home would the Kidnap coverage under Wrap+ Executive Liability have kicked in? Lastly poor Bob Cratchett could have benefited from DocuSign to lighten his workload.

All of the Christmas Carol versions as well as most of the other Christmas movies had a planned celebration (e.g. Fezziwig's party) and/or parades which would require Event Liability.

Other movies had their own unique exposures:

How the Grinch Saved Christmas

An x-ray machine broke when his heart grew three sizes (Office Pac).

If a burglar injuring himself during a break-in is covered, then what if the Grinch tries to sue for back injury from being stuck in a chimney? Would the homeowners be enough? They better have Personal Umbrella.

The Grinch also lived in a cave which would almost certainly be Non-standard which fortunately has optional Pet Insurance for Max.

It's A Wonderful Life

They ran a Building & Loan so Community Banks & Surety Bond again obviously, but what about the house he eventually bought? Remember George throwing stones at it while it stood empty, there you have an opportunity for Vacant Dwelling - Non-standard.

Jingle All the Way

Huge fight as customers fight for TurboMan action figure? Store Pac.

Home Alone

I hope the family took out Travel Insurance.

While Kevin's ingenuity saved his family's home and valuables, it opened them up to massive liabilities The iced over steps, heated doorknob, swinging paint cans, and blow torching are just a few examples!

Christmas Vacation

Various homeowners here so let's start with that fire-waiting-to-happen electrical nightmare of plugs for all his exterior decorations, all through a single outlet no less.

There was the damaged gutter shooting an ice spear into the neighbor's window and stereo, plus water damage when it melted.

All the damage from the Rottweiler chasing the squirrel means Valuable Articles.

I certainly hope Cousin Eddie had RV Coverage.

Lastly remember Clark was planning to put in a pool with his Christmas bonus!

Miracle on 34th Street

Kris Kringle bopping the shrink on the nose with his cane… sounds like liability for damages as well as the expenses of the legal trial.

A Christmas Story

Do I really have to mention "you'll shoot your eye out"?

New or old these Christmas movies can really get the old insurance juices flowing. They may have even inspired this insurance themed version of Twas the Night Before Christmas. For a chuckle here are some bizarre Christmas claims from "across the pond."

From the whole gang of elves at Big "I" Markets, we hope you have a wonderful Christmas however you choose to celebrate it.

_______________________________________

Webinars

Join DocuSign for an Introduction to ESignature

Join DocuSign for a complimentary webinar on January 14th at 1PM EST to learn more about DocuSign for your agency. DocuSign staff will show you how you can use DocuSign for everything from new policy applications to coverage election forms. DocuSign will cover the basics, including how to take advantage of your exclusive Big "I" member price discount, and leave plenty of time for you to ask us questions:

-

Legality and security: We'll show you how DocuSign is a best practice in keeping you and your clients safe

-

Ease and convenience: See what your clients will see when you send documents through DocuSign, and learn just how easy it is to sign

-

Sending, templates and account management: We'll get you up to speed on setting up your account, short cuts with document templates, and account management 101

Register online for the January 14th session. Learn more about your exclusive Big "I" DocuSign discount at www.iiaba.net.

+++++

Insurance in the Headlines

Mark your calendars for the first Big "I" Virtual University webinar of 2016 and join VU expert Bill Wilson as he presents "Insurance in the Headlines." This three-hour program examines over a dozen current issues in the news (both consumer and industry) and their insurance implications with topics ranging from: homeowners insurance loopholes, car 'sharing' economy and resulting coverage gaps, driverless and 'wired' vehicle danger, fracking, landscape of terrorism, parents sued for failure to immunize children, climate change, home and business under- or -over-insured, NARAB, diversity/generation changes and cyber issues.

Insurance in the Headlines

January 27, 2016 - 1:00 to 4:00 p.m. EST

Cost: $79

Click here to register

By the end of the webinar attendees will be better able to counsel customers who question the exposures to loss of these issue and then respond (where possible) by matching them to insurance products and risk management techniques that can also help minimize agency E&O exposure. Webinar questions can be sent to Virtual University staff.

+++++

Remember that you can view the following webinars 24/7 by checking out the BIM Webinar Library. To do that log onto Big "I" Markets and click on "Publications".

- Personal Liability Trends - Fireman's Fund

- TravPay

- Commercial Lessor's Risk

- Affluent Homeowners

- Travelers Select Products (series)

- Travel Insurance

- Community Banks

- XS Flood

- Real Estate E&O

- RLI Personal Umbrella

- Affluent Homeowner

- "Oh, by the way...Flood Sale"

- Habitational

- Non-standard Homeowner

- Student Housing

+++++

BIM WEBSITE TRAINING WEBINAR

For all you folks who recently registered for Big "I" Markets, remember you can participate in a webinar from the comfort of your office to help you learn how to navigate around the system. Every Thursday at 2:00 p.m. EDT we'll show you how to navigate the Big "I" Markets platform, including how to submit a quote! A recording of this webinar can be found under "Publications" after logging into Big "I" Markets.

________________________________________

By Paul Buse, President of Big I Advantage®

Recently the question arose about average agency contingency and standard commissions. Unfortunately, the answers are unanswerable or at least, not easily answerable from standard sources of industry information. As students of the industry, however, sometimes knowing what is not knowable is, well, good to know.

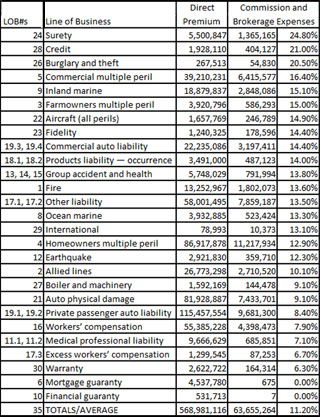

What we do know is that the average commission on all lines of P&C business reported by insurers to their regulators is about 11% of direct written premiums. Contingencies by the same premium denominator are .70% (that is, less than 1% of premium). That makes contingencies about 6% of average total commissions paid out. For independent agencies specifically, since contingencies are not generally paid via direct and other non-independent agent forms of distribution, one can assume the average for an independent agent would be higher than 6% of total commissions. In fact, IIABA Best Practices studies find that for the typical Best Practices participating agency contingencies are between 6-10% of total revenues.

The tough questions are what lines of business have the highest contingencies paid out and which states have the highest commissions, on average. The latter question, in theory, you can get answered. The Insurance Expense Exhibit (aka "IEE") is filed by insurers each year and it does include commissions by line of business and that is available by state. So, getting that data is possible but it would be a special request to the data miners of our industry like A.M. Best. You cannot get by product or by state contingency commission data. Contingency commission are only generally tracked and not allocated to each type of insurance or to each state. So, said differently, you can compare the average commission on homeowners, by state, but you can't find out which state pays out the most contingencies on their homeowners nor can you get the contingencies paid out on homeowners in all states.

Click for larger version

Source: A.M. Best Aggregates and Averages IEE and Underwriting and Investment Exhibit

________________________________________

Here are the top three items that got BIM agents clicking from our last edition... see what you missed!

-

Personal Umbrella Claims Examples

-

MiddleOak Apartment & Condominium

-

Not-For-Profit Board Liability Coverage

________________________________________

According to the American Veterinary Medicine Association, the percentage of households owning a dog ranges from about 30% in cold weather states to about 45% in warm weather states. As a result, dog parks are a growing trend across the nation.

According to the American Veterinary Medicine Association, the percentage of households owning a dog ranges from about 30% in cold weather states to about 45% in warm weather states. As a result, dog parks are a growing trend across the nation. Join DocuSign for a complimentary webinar on January 14th at 1PM EST to learn more about DocuSign for your agency. DocuSign staff will show you how you can use DocuSign for everything from new policy applications to coverage election forms. DocuSign will cover the basics, including how to take advantage of your exclusive Big "I" member price discount, and leave plenty of time for you to ask us questions:

Join DocuSign for a complimentary webinar on January 14th at 1PM EST to learn more about DocuSign for your agency. DocuSign staff will show you how you can use DocuSign for everything from new policy applications to coverage election forms. DocuSign will cover the basics, including how to take advantage of your exclusive Big "I" member price discount, and leave plenty of time for you to ask us questions:

Last weekend I realized that I had been working way too hard when all I could see were the multiple risks and exposures every time I saw a commercial for all the classic Christmas movies. Right off, every time Santa landed on roof, I thought of hooves damaging shingles, wondered if the roof is reinforced to hold the weight and speaking of weight, chimney damage if the trip down is a little tight. Then there are expensive rugs damaged by sooty footprints. What if Santa had his primary residence in the US instead of the North Pole, did you know he could get the reindeer covered under the Affluent program?

Last weekend I realized that I had been working way too hard when all I could see were the multiple risks and exposures every time I saw a commercial for all the classic Christmas movies. Right off, every time Santa landed on roof, I thought of hooves damaging shingles, wondered if the roof is reinforced to hold the weight and speaking of weight, chimney damage if the trip down is a little tight. Then there are expensive rugs damaged by sooty footprints. What if Santa had his primary residence in the US instead of the North Pole, did you know he could get the reindeer covered under the Affluent program?