By Brandon T. Boyd, AVP - Underwriting Manager, International Casualty

Don't let a class trip or study abroad opportunity turn into an expensive lesson for your client. Don't let a class trip or study abroad opportunity turn into an expensive lesson for your client.

More than 100,000 Americans study abroad each year. Things usually go smoothly, but what happens when they don't? When the world is your classroom, reducing the risk associated with studying and teaching outside the U.S. is paramount.

Educational institutions that sponsor such programs leave themselves open to a host of exposures associated with the uncertainties of overseas travel. International liability insurance and travel assistance programs are a must for schools that sponsor study abroad programs and trips or have employees and faculty that travel or live outside of the U.S. for job-related reasons. Scenarios like those below happen every day.

|

Situation |

Solution |

|

An American college student trips and falls while studying in Ireland, resulting in spinal cord injury. To receive proper medical treatment, she is medically evacuated to London. Total repatriation cost exceeds $30,000. |

International Advantage pays repatriation costs under its Executive Assistance® Services. |

|

A chaperone traveling with U.S. students causes an accidental fire in the German youth hostel where the group is staying. Significant damage results. |

International Advantage responds to the damages under the Commercial General Liability portion of the policy. |

An American student studying in London exhibits symptoms of appendicitis. Seeking medical help at a local hospital, she is informed that patients must pay cash in advance. |

The Executive Assistance® Services package of emergency medical, travel and security assistance services found within the International Advantage policy. Available around the clock, it provides access to English-speaking representatives who understand the region's cultures and customs. Prior to traveling, employees and volunteers can learn how to avoid potential risks associated with their destination. |

International Advantage® understands the risks associated with global travel and has designed an exclusive foreign package policy that is comprised of comprehensive coverage enhancements specifically tailored to educators. Our experienced underwriters, presence in over 50 countries, and our knowledge of local jurisdictions, make Chubb the ideal partner to provide risk management solutions for your educational clients.

Your clients are going abroad. Don't let them go without you.

International Advantage® Edge for Educators is available in all states. Learn more at Big "I" Markets or contact Brandon Boyd (302-476-6203) brandon.boyd@chubb.com.

|

Regardless of how comprehensive and well-planned your overall crisis response strategy may be, without the ability to communicate both effectively and consistently with all stakeholders, the recovery will fail before it even begins. Regardless of how comprehensive and well-planned your overall crisis response strategy may be, without the ability to communicate both effectively and consistently with all stakeholders, the recovery will fail before it even begins.

Join IIABA's endorsed provider of disaster recovery solutions, Agility, for a complimentary webinar session on crisis communication planning. In this session Agility will detail the basic fundamentals of a solid crisis communications strategy, including internal and external communications, alert notification, media relations and best practices for crafting the messages used during a disaster.

Due to the constant evolution of communications methods, the global nature of media and revolutionary new tools available, this aspect of your overall crisis response plan may be fluid over time, but it will always rely on some fundamental elements that must be in place before the next crisis arrives.

Don't miss this opportunity to get your plan in place. Join Agility Wednesday, June 29th, 2016 from 2:00 PM to 3:00 PM EDT for the Designing a Crisis Communications Strategy webinar.

Register today.

|

Custom made, or designer jewelry can be anything from a simple relatively inexpensive piece to multi-million dollar works of art. Fine jewelry includes pieces manufactured by the big old-name designers such as Harry Winston and Cartier as well as newer up-and-comers such as Anita Ko and Jennifer Fisher. Several of the last century's most fashionable women had large collections, which were often sold after their death. In 2014 Elizabeth Taylor led the list of the 10 most expensive jewelry collection auctions at a mere $137,235,575 including a nearly $12 million pearl necklace. Custom made, or designer jewelry can be anything from a simple relatively inexpensive piece to multi-million dollar works of art. Fine jewelry includes pieces manufactured by the big old-name designers such as Harry Winston and Cartier as well as newer up-and-comers such as Anita Ko and Jennifer Fisher. Several of the last century's most fashionable women had large collections, which were often sold after their death. In 2014 Elizabeth Taylor led the list of the 10 most expensive jewelry collection auctions at a mere $137,235,575 including a nearly $12 million pearl necklace.

The value of a piece of jewelry can vary depending on for what you need a price. The sale price can't be depended on either as pieces can be undervalued by the artist. Covering jewelry at the right amount requires expertise in the field, which is exactly what you can expect when working with Big "I" Markets to access Crown Coverage's Valuable Articles markets (personal & commercial) written on AXA Insurance Company paper.

Jewelry is just one of the coverages now available:

Jewelry

-

Minimum policy premium: $1,000

-

Target: $500K up to $30MM jewelry collections, higher limits available

-

Minimum: $75K minimum personal jewelry collections & at least 2 items

-

Replacement Cost Valuation

-

Competitive rates for collections kept in the residence, residence safes, and bank vaults

-

Scheduled or blanket policies

-

Worldwide coverage

-

No restrictions for California earthquake

Artist*

-

Minimum policy premium: $2,500

-

Minimum policy deductible: $1,000

-

Enhancement options include coverage for:

-

Commissioned works in progress

-

Non-commissioned works, if completed

-

Studio contents

Conservator*

-

Minimum Policy Premium: $2,500

-

Minimum Policy Deductible: $1,000

-

Valuation:

-

Objects in conservator's care, custody & control: Agreed Value

-

Furniture & fixtures: Replacement Cost

-

Enhancement options include:

-

Art reference library coverage

-

Studio contents coverage

-

"Workmanship" coverage for property damage

-

Bailee legal liability coverage

Dealer*

-

Minimum Policy Premium: $2,500

-

Minimum Policy Deductible: $1,000

-

Valuation: Cost Plus (+%) / Selling Less (-%) for inventory

-

Property included: inventory, loaned items & objects on consignment

-

Blanket coverage available with approved coverage locations

-

Enhancement options include:

-

Art fair/Trade show coverage

-

Bailee legal liability coverage enhancement available

-

Art reference library coverage

Exhibition

-

Minimum policy premium: $1,000

-

No policy deductible requirements, deductible options available for rate credits

-

Valuation:

-

Fine Art: Agreed Value

-

Exhibitry: Actual Cash Valuation or Replacement Cost

-

Scheduled policies

-

Worldwide coverage for US domestic insured

-

"Wall-to-Wall" / "Nail-to-Nail" coverage

-

Earthquake/Windstorm coverage based on availability

-

Flexible term by day, month or year

-

Multi-year policies available

-

Policy can be rated for multiple venues and storage needed between sites

Historic Property*

-

Available for corporation-owned properties, excludes private residences

-

Minimum policy premium: $2,500

-

Minimum policy deductible: $1,000

-

Building contents, real property and business interruption covered under one policy

-

Valuation:

-

Building contents: Agreed Value, Current Market Value, or Current Market Value-150%

-

Real property: Agreed Value or Replacement Cost

-

Coverage for multiple buildings and locations

Museum*

-

Minimum Policy Premium: $1,000

-

Minimum Policy Deductible: $1,000 (Owned property on premises)

-

Coverage for owned (permanent collection) & loaned (short & long-term) objects

-

Valuation:

-

Owned property: Current Market Value

-

Loans: Agreed Value

-

Worldwide territory

-

Large line capacity

-

Flexibility in limits throughout policy term to accommodate exhibitions

-

Blanket coverage for single or multiple venues

-

Coverage for outdoor sculptures

Private Corporate*

-

Minimum Policy Premium: $1,000

-

Target: Any limit (minimum premium applies)

-

No policy deductible requirements, deductible options available for rate credits

-

Replacement Cost Valuation

-

Scheduled or blanket policies

-

Newly acquired objects automatically covered, up to 25% of the limit

-

Worldwide coverage

-

Coverage available for single or multiple locations

-

Art reference library coverage available

The Stand-alone Valuable Articles Program - [Commercial or Personal] can be found again on www.bigimarkets.com and is available in all states.

* Earthquake restrictions apply in California. Windstorm coverage restrictions apply in Florida and coastal locations.

|

Remember that you can view the following webinars 24/7 by checking out the BIM Webinar Library. To do that log onto Big "I" Markets and click on "Publications".

-

TravPay

-

Commercial Lessor's Risk

-

Affluent Homeowners

-

Travelers Select Products (series)

-

Travel Insurance

-

Community Banks

-

Affluent Homeowner

-

Real Estate E&O

-

RLI Personal Umbrella

-

"Oh, by the way...Flood Sale"

-

Habitational

-

Student Housing

+++++

BIM WEBSITE TRAINING WEBINAR

For all you folks who recently registered for Big "I" Markets, remember you can participate in a webinar from the comfort of your office to help you learn how to navigate around the system. Every Thursday at 2:00 p.m. EDT we'll show you how to navigate the Big "I" Markets platform, including how to submit a quote! A recording of this webinar can be found under "Publications" after logging into Big "I" Markets.

+++++

Big "I" Virtual University Webinars

Don't miss the following education opportunities provided from the Big "I" Virtual University experts that focus on topics agents need to know to make a smart start in 2016. For more information, contact national staff.

-

June 6. "First Monday LIVE!" is a free monthly webcast hosted by the VU's own Bill Wilson and guests on the first Monday of the month to discuss the wide world of insurance from seemingly non-insurance topics. Each 30-minute webisode covers "what's going on" (drones, car sharing, concealed weapon laws, legalized marijuana, legislative issues) and the implications. May topics are pending as information is seen in the news. Click here to learn more and register and here to access the recordings.

-

June 22. "Drones AKA Unmanned Aerial Vehicles" One of the most fluid issues in insurance today involves drones. The technology, regulations, exposures, and coverages seem to change on a daily basis. This webinar is designed to bring the participant completely up to date with regard to the technology, laws and regulations, evolving exposures/uses, and what coverages (both personal and commercial lines) are available in the marketplace. It will also dispel some of the myths about coverage (or lack thereof), especially in the area of privacy. Click here to learn more and to register.

-

July 20. "Fixing Personal Lines Coverage Gaps" Through scores of real-life claims examples and court cases, this program examines common coverage gaps found in many personal lines policies and addresses the remedies for such gaps in the form of insurance products or risk management techniques Click here to learn more and register.

+++++

Designing a Crisis Communications Strategy with Agility

In this session Agility will detail the basic fundamentals of a solid crisis communications strategy, including internal and external communications, alert notification, media relations and best practices for crafting the messages used during a disaster.

Due to the constant evolution of communications methods, the global nature of media and revolutionary new tools available, this aspect of your overall crisis response plan may be fluid over time, but it will always rely on some fundamental elements that must be in place before the next crisis arrives.

Don't miss this opportunity to get your plan in place.

Wednesday, June 29th, 2016

2:00 PM to 3:00 PM EDT

Cost = Free

Register today.

|

STUDENT OF THE INDUSTRY PARTING SHOT

Hand Wringing and Flood Insurance…

How Far Off Is Success Really?

By Paul Buse, President of Big I Advantage®

Recently there has been a lot of press on flood insurance, notably last Friday on NPR's All Things Considered: "Lawmakers To FEMA: Flood Plan Overhaul Is 'Too Little, Too Late'." The gist of the article left me with some unanswered questions on the analysis but on looking at industry data in trying to make sense of the author's profitability conclusions, I was struck something positive. I'm always astounded how well federal flood insurance works and for how long it has worked. Lost on many outside our industry is the idea that the insurance industry does an impressive job on delivering what insurance text books would tell you is IMPOSSIBLE: Flood insurance lacks "independent exposure units." That is, with this loss exposure if there is one loss, there are many losses.

Of course, given the reality of the challenge of flood insurance, the federal government stepped in and it insures the losses and it uses the services of about 30 insurance companies to manage losses. Few consider the alternative of a federal disaster workforce large enough to handle the next major hurricane sitting idle between catastrophes as a viable solution. There were issues with loss adjustments in Hurricane Sandy but considering the challenge, would a government workforce have been better? We'll have to wait and let Congress decide.

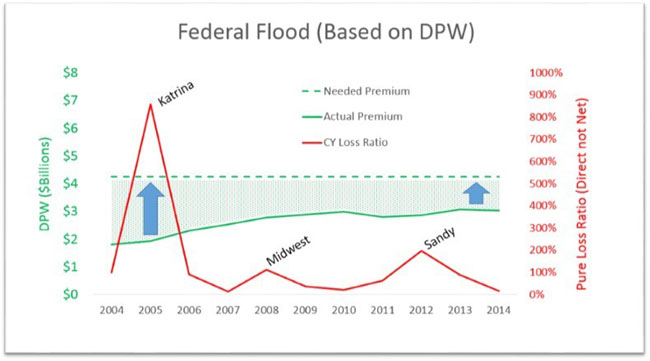

On the positive side, let's not lose sight that progress that has been made. We landed a functional vehicle on the moon. Is some sort of sustainable and functional disaster insurance approach harder than that? When one considers the potential of catastrophe bonds and the capabilities of U.S. insurance industry, I am optimistic a solution that can bridge the gap. Below is a graphical representation of how close we are and, also and importantly, the fact that we are getting closer. Consider in the last 11 years we have had Katrina, long-term and widespread Midwestern flood and Sandy and we are only the green shaded area short of something the insurance industry would provide coverage for on its own? You can draw your own conclusion but it's more than half-way there and getting closer.

Click for larger version

Source: : A.M. Best Aggregates & Averages, Industry By Lines Direct Written Premium and Loss Ratio (note, loss ratio above does not include loss adjustment expense or LAE). The above consideration of "needed premium" (shaded green and blue arrows) is a general one. What is shown is $4.25 billion in premiums as needed to cover the insured loss exposures since 2004. That is based on the average losses over past 11 years plus 3.6% LAE increased by the approximately insurance industry expenses of 30%.

The Answer to Last Week's Contest: Claim Cost Inflation

The answer to last week's puzzle on the mathematics of claim cost inflation are based on the combination of Frequency and Severity and the result in claim costs increasing. Total claim cost increases result from the product of Frequency change (expressed as how 100% would change) and Severity (expressed the same way or "1" + the percent change). In our example severity was assumed to increase by 3.141592%. The question was what would frequency have to increase by to result in total claim cost increases of 6%. Some of you identified the number as a truncated version of pi. There is not significance to that choice beyond it makes for a long number so it was easy to see if you got the right answer. Below is the answer, which required some algebra to get the exact answer.

(1 + Severity%) * (1 + Frequency%) = (1 + LossCostChange%)

1.03141592*(1+Frequency%)=1.06

Frequency%=1.06 ÷ 1.03141592

Frequency%=.02771344 or 2.771344%

P.S. I can't possibly discuss flood without encouraging you to check out our very own Big "I" Flood program. Visit www.iiaba.net/Flood to learn more about our WYO program with Selective.

|

BIG "I" MARKETS SALE OF THE WEEK

Congratulations to our agent in Texas on a valuable articles sale of $3,732 in premium!

|

|