A puzzle box (sometimes called a monkey puzzle box) has sliding, shifting, and twisting parts that have to be moved in just the right order before it will open. When I was a little kid my sister had one and asked me to see if I could open it. She watched as I pushed, shifted, and prodded it for what seemed like half a day (probably not more than 10 minutes). Then she took pity and told me what to do to open it. Once she told me, it was simple, but I needed her to guide me through it, step-by-step. A puzzle box (sometimes called a monkey puzzle box) has sliding, shifting, and twisting parts that have to be moved in just the right order before it will open. When I was a little kid my sister had one and asked me to see if I could open it. She watched as I pushed, shifted, and prodded it for what seemed like half a day (probably not more than 10 minutes). Then she took pity and told me what to do to open it. Once she told me, it was simple, but I needed her to guide me through it, step-by-step.

Covering Community Banks might seem the same way. Without guidance you could be shifting that puzzle box and never get it. Fortunately for you, Travelers understands the complexities of community banks insurance and will guide you every step of the way until you reach the nice commission inside.

Travelers understands that few agents have extensive knowledge about banks that they have accumulated so they will walk with you through the entire operation, explaining the process and details of coverages. They will even go with you to pitch the coverage to the client. You don't have to fear offering Community Bank coverage. You are not alone because Travelers is there to guide you every step of the way.

Community Banks need coverages that can keep up with diverse and changing responsibilities and Travelers® has been serving banks since 1890.

Critical Policy Features:

-

Directors and officers liability, with excess directors and officers individual coverage

-

Crime

-

Employment practices liability

-

Bankers professional liability

-

Trust errors and omissions liability

-

Lender liability

-

Fiduciary liability

-

Financial institution bond

-

Kidnap and ransom

-

General liability, auto liability and physical damage as well as workers compensation and property

-

CyberRisk protection

A specimen policy is located in "Product Resources" on www.bigimarkets.com.

Travelers SelectOne®, underwritten by Travelers Casualty and Surety Company of America, is endorsed by the Independent Community Bankers of America.

To find your local community bank, visit ICBA's community bank locator at www.icba.org/locate. Simply type in your zip code and the app will show you all the community banks in your area.

|

When it comes to covering the architects in your community, where do you turn? Did you know that you have access to comprehensive professional liability coverage for architects, engineers and surveyors? When it comes to covering the architects in your community, where do you turn? Did you know that you have access to comprehensive professional liability coverage for architects, engineers and surveyors?

CBIC Design Professionals Insurance, an RLI Company, provides comprehensive professional liability coverage for architects, engineers, and surveyors. CBIC has deep knowledge in the professional services and construction industries, which means when you work with a CBIC underwriter, risk manager or claim manager, you're speaking with a longtime veteran who has both the expertise to understand a firm's needs and the decision-making authority to get the job done.

The policy features:

-

Defendants' reimbursement of expenses - $500 per day subject to $12,500 maximum (reimbursement applies day one)

-

ADA/FHA/OSHA regulatory or administrative action reimbursement - $30,000 per policy period

-

Free pre-claims assistance

-

Disciplinary proceedings reimbursement - $5,000 per proceeding

-

Definition of "Insured Person" includes temporary or leased personnel and retired personnel

-

Predecessor firm coverage, including joint ventures

-

Worldwide coverage

-

Liberalization clause

-

Blanket waiver of subrogation provision

-

Punitive damages extension where allowable by law

-

Deductible mediation credit of 50% subject to a $12,500 maximum

-

Automatic 90-day coverage for acquired or merged entities

-

5 Year Extended Reporting Period

-

Innocent insured provision

-

Consent to settlement provision - 50/50 co-share between "Insured" and "Insurer"

-

60-day automatic extended discovery period

-

Automatic excess coverage for separately insured projects

-

Management Pack Enhancement Endorsement (Directors & Officers, Fiduciary and Employment Practices Liability Insurance Coverages)

-

High Self Insured Retention Program (Top & Drop)

Learn more by logging into Big "I" Markets and clicking on Big "I" CBIC Design Pros--an RLI Company from the commercial products menu.

|

According to the U.S. Coast Guard, there are close to 12 million registered recreational boats in the United States. With so many boaters enjoying the waterways, it is no surprise that more than 4,000 boating accidents, involving more than 5,300 vessels, were reported in 20141, with far more that go unreported. Property damage reported in 2014 totaled approximately $39 million. Although these statistics represent little change from 2013, the fatality rate showed an increase of close to 9%. According to the U.S. Coast Guard, there are close to 12 million registered recreational boats in the United States. With so many boaters enjoying the waterways, it is no surprise that more than 4,000 boating accidents, involving more than 5,300 vessels, were reported in 20141, with far more that go unreported. Property damage reported in 2014 totaled approximately $39 million. Although these statistics represent little change from 2013, the fatality rate showed an increase of close to 9%.

Though the statistics are alarming, the risk of injuries and accidents can be minimized. Chubb Recreational Marine Insurance® is pleased to offer a top ten list of tips to help recreational boaters stay safe and reduce the number of preventable accidents that occur each year. There's no mystery to boating safety. Understanding and obeying navigational rules and safety procedures has proven to save lives while reducing injuries and property damage. Having the proper boat and yacht insurance in place will help make boating more stress-free and enjoyable as well. Read on to learn more about Chubb Recreational Marine Insurance® and its industry-leading protection for boats and yachts.

Chubb Recreational Marine has been a leading provider of boat and yacht insurance for decades, offering comprehensive policies for private pleasure watercraft of all sizes. The Yachtsman®/Boatsman® Policy provides all-risk protection for a wide range of pleasure boats and yachts, including select occasional charter opportunities, along with many unique benefits and features. Some eligibility info:

Yachts (27' or greater and up to $5 million in value) - Yachtsman®/Boatsman® Policy

-

Length: Minimum 27' - no maximum

-

Hull values: No minimum - $5 million maximum

-

No high performance vessels (refer to our Performance Policy)

-

Available in all states except Alaska and limited availability for permanently moored Florida risks: Florida eligibility is only available for preferred vessels over $1 million in value with a permanent, full time captain employed

-

Pleasure use

-

Owners/Named insured must be 21

-

Vessel owners should be experienced in similar size/type vessels. Refer first time boat owners or those making a jump of 10' or more.

-

Condition and Valuation surveys required at 10 years of age for salt water risks. 20 years of age for fresh water risks.

-

Lay-ups - afloat or ashore

Small Boats (less than 27') - Yachtsman®/Boatsman® Policy

-

Length: no minimum - maximum under 27'

-

Hull values: no minimum - no maximum

-

No high performance boats (refer to our Performance Policy)

-

Bass boats acceptable. Pontoon boats on inland waters acceptable.

-

Available in all states except Alaska

-

Limited availability for permanently moored Florida risks

-

Pleasure use

-

Owners/Named insured must be 21

-

Some boating experience is desired - refer first time boat owners

Elite Yacht® Program (70’ or larger, valued at $3 million or greater, having a full-time paid captain) The Elite Yacht® Program is Chubb's exclusive program to fulfill the specialty insurance needs of luxury yacht owners with vessels valued at $3 million or greater. Exceptional yachts require specialized insurance protection and the Elite Yacht Program provides significantly increased benefit levels for a broad range of coverage, along with many other valuable and unique policy features. Log into www.bigimarkets.com for full details.

Personal Watercraft (PWC)

-

Owners/Named insured must be 21

-

Licensed driver

-

Personally Owned

-

Pleasure Use only

-

No more than 2 unrelated owners

-

Speed up to 60 mph

-

Seats 2-3 people

-

7 ft. up to 16 ft. in length

-

No modifications

-

Water-jet propulsion

-

Owner and Operators must have clean MVR (0-2 points)

-

MVRs required if operator under 25 years old

Log into www.bigimarkets.com and choose any of these products from the personal products menu to review full coverage details or to submit a quote.

(1) http://www.uscgboating.org

|

Remember that you can view the following webinars 24/7 by checking out the BIM Webinar Library. To do that log onto Big "I" Markets and click on "Publications".

-

TravPay

-

Commercial Lessor's Risk

-

Affluent Homeowners

-

Travelers Select Products (series)

-

Travel Insurance

-

Community Banks

-

Affluent Homeowner

-

Real Estate E&O

-

RLI Personal Umbrella

-

"Oh, by the way...Flood Sale"

-

Habitational

-

Student Housing

+++++

BIM WEBSITE TRAINING WEBINAR

For all you folks who recently registered for Big "I" Markets, remember you can participate in a webinar from the comfort of your office to help you learn how to navigate around the system. Every Thursday at 2:00 p.m. EDT we'll show you how to navigate the Big "I" Markets platform, including how to submit a quote! A recording of this webinar can be found under "Publications" after logging into Big "I" Markets.

+++++

Big "I" Virtual University Webinars

Don't miss the following education opportunities provided from the Big "I" Virtual University experts that focus on topics agents need to know to make a smart start in 2016. For more information, contact national staff.

-

July 11. "First Monday LIVE!" is a free monthly webcast hosted by the VU's own Bill Wilson and guests on the first Monday of the month to discuss the wide world of insurance from seemingly non-insurance topics. Each 30-minute webisode covers "what's going on" in the news and the implications. The July broadcast is in development as topic areas are discovered. Click here to learn more and register and here to access the recordings.

-

July 20. "Fixing Personal Lines Coverage Gaps" Through scores of real-life claims examples and court cases, this program examines common coverage gaps found in many personal lines policies and addresses the remedies for such gaps in the form of insurance products or risk management techniques Click here to learn more and register.

-

August 23. "Fixing Commercial Lines Coverage Gaps" Through scores of real-life claims examples and court cases, this program examines common coverage gaps found in many commercial lines policies and addresses the remedies for such gaps in the form of insurance products or risk management techniques CE credit available for attendees in AZ, CT, MI, ND, WA, WY. Click here to learn more and to register.

+++++

Designing a Crisis Communications Strategy with Agility

In this session Agility will detail the basic fundamentals of a solid crisis communications strategy, including internal and external communications, alert notification, media relations and best practices for crafting the messages used during a disaster.

Due to the constant evolution of communications methods, the global nature of media and revolutionary new tools available, this aspect of your overall crisis response plan may be fluid over time, but it will always rely on some fundamental elements that must be in place before the next crisis arrives.

Don't miss this opportunity to get your plan in place.

Wednesday, June 29th, 2016

2:00 PM to 3:00 PM EDT

Cost = Free

Register today.

|

STUDENT OF THE INDUSTRY PARTING SHOT

Know your State Guaranty Fund

What you Find Will Probably Surprise You

By Paul Buse, President of Big I Advantage®

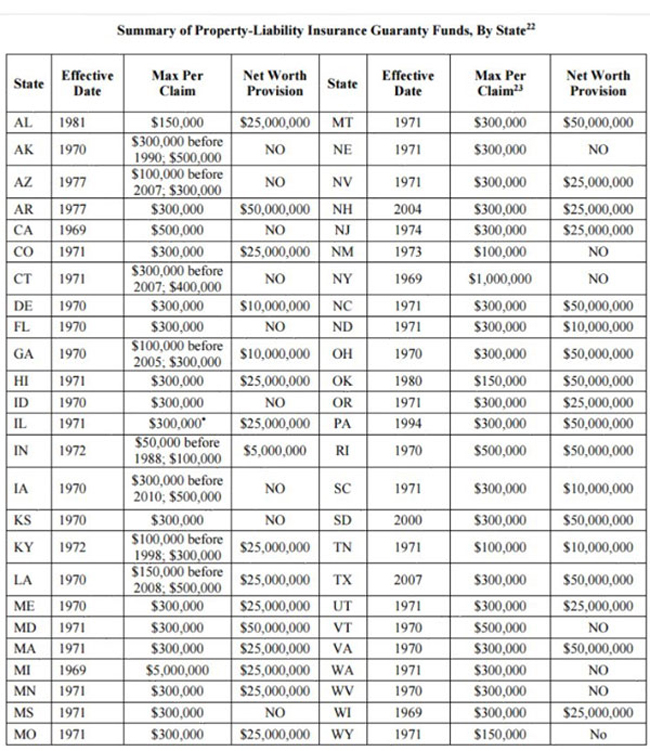

Recently I was in an email "conversation" with Georgia State University professor of Risk Management & Insurance, George H. Zanjani, and the topic of State Guaranty Funds surfaced. It surfaced after his posing the question of whether surplus lines could reach 10% market share in what might become a "new normal" for such placements. This got my attention as surplus lines placements are not generally covered for professional liability allegations if due to the non-admitted insurer's insolvency. In a related, but separate paper, contributed to by Professor Zanjani there was a very concise summary of state guaranty fund coverage by state. It is reproduced below and an on-line version is available (Go to page 30 of 54 and Table 1).

What are some surprises from looking at state guaranty fund laws? First, there are limits on the insured's "Net Worth" varying from $10,000,000 to $50,000,000 (see below). This appears it can apply to personal lines or commercial insureds and claims that are covered by the guaranty fund can become a liability for both property and liability claims. Second, insureds covered by placements involving the Federal Risk Retention Act may not be covered by the state guaranty fund? Yes, possibly including Risk Purchasing Groups. I was not understanding a reference on the Insurance Information Institute's website to Risk Purchasing Groups but after looking at a few state guaranty fund statutes, exclusion of RPGs certainly may be the case in some states. Do you want to research your state Guaranty Fund? You can probably find a link to it at the National Conference of Insurance Guaranty Funds (NCIGF) at www.ncifg.org under Resources and Guaranty Fund Web Sites".

Click for larger version

Source: Deng, Y., Leverty T.J., and Zanjani, G. Market Discipline and Government Guarantees: Evidence from the Insurance Industry. Page 30.

|

BIG "I" MARKETS SALE OF THE WEEK

Congratulations to our agent in Louisiana on a performance bond sale of $12,365 in premium!

|

|