Big "I" Markets has been without an event liability market since February. As we searched for a new market, we found an old friend with a fresh new brand. We are thrilled to announce the return of Event Insurance Now (previously known as Gales Creek Insurance), now with fully admitted markets, broader coverages, and greater appetite.

Public liability for single day, short term, and annual policies is available. In addition to GL, HNOA liability, umbrella and liquor liability can be offered. One day events generally can be quoted in a single business day.

Coverage can be placed for the individual or entity hosting the event quickly. For those providing services to events, such as DJ, caterers, florists, and photographers, Event Insurance Now has a product as well. Vendors can secure coverage on a short term or annual basis.

Weddings start at $225 and can be at public venues or private residences. Parades start at $335.

We have no limit on event size: bring us your largest accounts! Event Insurance Now can also insure overnight events with camping.

Here is a short list of covered events:

-

Art Festivals/Shows

-

Auctions (at private residence OK)

-

Auto Shows

-

Business Meetings and functions

-

Campouts

-

Concerts: Indoor/Outdoor (All genres: excluding Rap/Hip Hop)

-

Conferences/Conventions

-

Comedy Shows

-

Consumer Shows: Craft, Boat, Art, Holiday, Home, Fishing, Vacation, Bridal, Consignment

-

Dance Show/ Music Recitals

-

Estate Sales

-

Exhibitions/Exposition (no sports)

-

Fashion Shows

-

Fundraising Events

-

Festivals (all types)

-

Fireworks Display*

-

Instructional classes

-

Job Fairs

-

Parades (any size) and parade participants*

-

Parties: Banquets, Weddings, Anniversaries, Graduations

-

Picnics

-

Religious Assemblies

-

Reunions: Class & Family

-

Seminars

-

Social Receptions: Dinners, Luncheons, Ladies club events

-

Speaking Engagements, Lectures

-

Sports Tournaments/Exhibitions (spectator liability only)

-

Theatrical Events and Musicals

-

Tradeshows

-

Weddings and Wedding receptions

* Additional underwriting required

Event Liability Insurance is available in all states, so lead a parade over to Big "I" Markets and check it out.

|

How do you sign up to receive your Big "I" Markets commission via EFT? It's easy to access from "Online Registration" at www.bigimarkets.com.If you are your agency's System Administrator, you should first assemble the information you will need to update your registration. (Only a user with System Admin and Organizational Admin access can update your registration.) How do you sign up to receive your Big "I" Markets commission via EFT? It's easy to access from "Online Registration" at www.bigimarkets.com.If you are your agency's System Administrator, you should first assemble the information you will need to update your registration. (Only a user with System Admin and Organizational Admin access can update your registration.)

Gather your banking information (and Tax ID number if it has changed), and the email address of the person to receive the notification the commission statement is available on Big "I" Markets. Go to www.bigimarkets.com and click on "Register/Update EFT Commission Deposits" in the upper right area of the screen. To add your agency's banking information follow the steps below:

-

Verify/Enter the agency information on Step 1.

-

Verify/Enter agency tax ID and banking information on Step 2.

-

Enter whether you are tax exempt or not. If you have received a notification that you are not exempt from withholding, you must check "NO". If you are unsure, you should confirm with your tax advisor.

-

Click 'Next' to save the information.

NOTE: You may exit the online registration at Step 3 and your EFT sign up will be complete. However, we encourage you to continue and verify all of the information for your agency, including adding any new users.

We know security of your information is a primary concern. We use secure socket layer (SSL) protocol to secure the information exchanged between the server and browser. SSL encrypts the data before it is sent over the Internet and decrypts at the server side. We are utilizing our standard security protocols to protect your data on our server.

If you have any questions or concerns, or require technical assistance, please contact us at bigimarkets@iiaba.net or 703-647-7800.

|

Imagine this scenario: A bank handles its employee retirement plan and suddenly finds itself being sued by the Labor Department for charging excessive fees. Even if it turns out to be just sloppy bookkeeping, thousands of dollars will need to be spent on the defense. Hundreds of thousands or even millions could be levied/awarded if the charges are true.

Even when a bank fails, its officers can still be sued and it's not true that the FDIC only goes after the directors and officers of those that have director and officers' liability insurance.

Offering coverage for a local bank, including D&O, is easier than you think with the Big "I" Markets Community Banks Business Insurance Program. Because our partner Travelers understands that few agents have extensive knowledge about banks, they will walk with you through the entire operation, explaining the process and details of coverages. Travelers will even go with you to pitch the coverage to the client. Travelers is there to guide you every step of the way.

Critical Policy Features:

-

Directors and officers liability, with excess directors and officers individual coverage

-

Crime

-

Employment practices liability

-

Bankers professional liability

-

Trust errors and omissions liability

-

Lender liability

-

Fiduciary liability

-

Financial institution bond

-

Kidnap and ransom

-

General liability, auto liability and physical damage as well as workers compensation and property /li>

-

CyberRisk protection

To find your local community bank, visit ICBA's community bank locator at www.icba.org/locate. Simply type in your zip code and the app will show you all the community banks in your area.

A specimen policy is located in "Product Resources" on www.bigimarkets.com.

Travelers SelectOne®, underwritten by Travelers Casualty and Surety Company of America, is endorsed by the Independent Community Bankers of America.

|

| |

Remember that you can view the following webinars 24/7 by checking out the BIM Webinar Library. To do that log onto Big "I" Markets and click on "Publications".

-

AIG Private Client Group Homeowner - Overview NEW

-

TravPay

-

Commercial Lessor's Risk

-

Affluent Homeowners

-

Travel Insurance

-

Community Banks

-

Affluent Homeowner

-

Real Estate E&O

-

RLI Personal Umbrella

-

"Oh, by the way...Flood Sale"

-

Habitational

-

Student Housing

+++++

BIM WEBSITE TRAINING WEBINAR

For all you folks who recently registered for Big "I" Markets, remember you can participate in a webinar from the comfort of your office to help you learn how to navigate around the system. Every Thursday at 2:00 p.m. EDT we'll show you how to navigate the Big "I" Markets platform, including how to submit a quote! A recording of this webinar can be found under "Publications" after logging into Big "I" Markets.

+++++

Big "I" Markets Product Webinars

Wednesday, December 7 - 2:00 - 2:30pm EST. AIG Private Client Group for affluent homeowners. This webinar will cover what qualifies as a collectible car, (classic, antique, exotic, etc.) plus the features of their Automobile coverage.

-

New Vehicle Replacement

-

High Liability Limits

-

Worldwide Coverage

-

OEM Parts

-

Cash Settlement Option

-

...and more

Click here to register.

+++++

Big "I" Virtual University Webinars

Don't miss the following education opportunities provided from the Big "I" Virtual University experts that focus on topics agents need to know to make a smart start in 2016. For more information, contact national staff.

-

November 16 - 1:00 - 3:00pm EST. "Builders Risk". Builders Risk insurance is meant to provide protection against the financial consequences of accidental losses which occur during the course of construction, renovation, or installations. This area of the insurance industry is largely misunderstood by many insurance professionals, including those that advise on the procurement of such insurance. This is further complicated by the fact that many insurers use differing proprietary coverage forms. Increase your knowledge in this two-hour webinar. Click here to learn more and register.

-

December 5 - 2:00 - 2:30pm EST. "First Monday LIVE!" is a free monthly webcast hosted by the VU's own Bill Wilson and guests on the first Monday of the month to discuss the wide world of insurance from seemingly non-insurance topics. Each 30-minute webisode covers "what's going on" in the news and the implications. The December broadcast is in development as subject matter is explored. Click here to learn more and register and here to access the recordings.

-

December 7 - 1:00 - 2:00pm EST. "What I've Learned in 47 Years In the Insurance Industry". A free webinar with parting thoughts from Bill Wilson who is retiring at the end of 2016 and whose career began in June 1969 when he graduated from high school and worked during the summer for the industry organization that had granted him a 4-year scholarship to college, majoring in fire protection engineering. Over the next 47 years, his career morphed from engineering to management to education, serving largely insurance carriers then independent insurance agents. Over the time, he's learned a few things you might find helpful. Click here to register.

|

STUDENT OF THE INDUSTRY PARTING SHOT

Bacteria Lawyers Insurance?

By Paul Buse, President of Big I Advantage®

In doing some research, I stumbled upon the birth of the first multiple line insurance policy in our fair industry: Homeowners. What a great story!

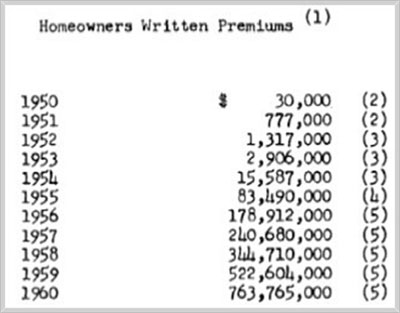

You can see the innovation turned out to be quite a nice premium event…and not the least for The Insurance Company of North America ("INA") who was the only writer of the line for several years. Before 1950 and when INA filed the form, most insurance was written by separately regulated and narrowly focused insurers writing only "property" (fire and extended perils) or "casualty" (liability and medical payments). In fact in the filing made on August 11, 1950 in Pennsylvania, the form was even called "Homeowners Policy Multiple Form." Before 1950 to duplicate the same outcome, you probably needed multiple policy issuing insurers to obtain Dwelling Fire Policy, a Personal Articles Floater and a Personal Liability Policy and you might still be missing extended perils on your home and medical payments. The situation was ripe for change.

Click for larger version

Source: Hunt, Jr., Frederick J. (1962). "Homeowners - The First Decade". Proceedings of the Casualty Actuary Society. Retrieved 2016-11-04

This brings me to the reason for my review of the origins of multiple line forms. Are we ripe for change? Do we need an omnibus multiple line form that would cover many of the coverages often not purchased by consumers… even though we know they should purchase them? We know too well the low penetration of personal umbrellas and lower penetration still is consumers purchasing high limits of Uninsured and Underinsured Motorist. What if we could combine other overlooked coverages to drive conversations with consumers? Think about in-home business coverage for all the work-at-home and 1099 situations. How about renters insurance for young adults and the rising exposure with millennials for non-owned automobile liability from rented or shared cars? What about all the dollars that flow into PDA "insurance" on consumer cell phone bills and coverage for property in storage facilities? What else might be added to something as "radical" in the day as homeowners was in 1950? Have an idea? Have an idea?

Do you think such a program would work on Big “I” Markets? Send me an email at paul.buse@iiaba.net.

|

Be one of the first five with the correct answers and win a $5 gift card (Starbucks, Dunkin' Donuts, Baskin Robbins, or Krispy Kreme).

Don't forget to answer the Tie Breaker!

Congratulations to this week's winners - Jack Harris (IN), Jane Hamada (CA), Nikki Eagle (NM), Megan Thomas (OK) & Cheryl Sedich (CT).

1. Who was the only Presidential candidate to receive electoral votes after death? - HORACE GREELEY

2. Insurbanc is located in a Connecticut town which George Washington passed through on several occasions during the Revolutionary War. He referred to the town as "the village of pretty houses." Name the town. - FARMINGTON

3. "What we've got here is failure to communicate" is a line from a movie released on this date (November 1) in 1967. Name the movie. - COOL HAND LUKE

TIE BREAKER

In the first baseball World Series in 1903 one player has the distinction of hitting the very first RBI and being struck out in game eight at the top of the ninth inning to end the series. Name the player. - HONUS WAGNER (Jimmy Sebring hit the first home run and "Hobe" Ferris commited the first error)

|

BIG "I" MARKETS SALE OF THE WEEK

|

|