Kansas Bankers Surety (KBS), a company that specialized in the writing of financial institution bonds for banks, has announced that it is withdrawing from bank insurance sales effective June 1, 2016. Kansas Bankers Surety (KBS), a company that specialized in the writing of financial institution bonds for banks, has announced that it is withdrawing from bank insurance sales effective June 1, 2016.

In the wake of this withdrawal, many banks will need to find a new surety market for their bankers blanket bond. Goldleaf Surety works with several surety companies that provide excellent markets for this bond.

The bankers blanket bond is fidelity coverage that offers protection to financial institutions for risks that are associated with the handling of large sums of cash and securities. Typically covered are losses which may be caused by:

-

Employee dishonesty

-

Forgery or alteration

-

Computer fraud

-

Funds transfer fraud

-

Kidnap, ransom, or extortion

-

Various money and securities fraud

-

Counterfeiting

Unlike deposit insurance which protects the actual depositor, the blanket bond protects the institution itself.

If you would like more information on bankers blanket bonds or need assistance replacing this coverage for your client, contact Goldleaf by logging onto www.bigimarkets.com. Simply select the appropriate bond type from the bond options on the commercial markets menu. You may also call Goldleaf directly at (888) 294-6747 and ask for Lori Olson.

|

When it comes to covering the architects in your community, where do you turn? Did you know that you have access to comprehensive professional liability coverage for architects, engineers and surveyors? When it comes to covering the architects in your community, where do you turn? Did you know that you have access to comprehensive professional liability coverage for architects, engineers and surveyors?

CBIC Design Professionals Insurance, an RLI Company, provides comprehensive professional liability coverage for architects, engineers, and surveyors. CBIC has deep knowledge in the professional services and construction industries, which means when you work with a CBIC underwriter, risk manager or claim manager, you're speaking with a longtime veteran who has both the expertise to understand a firm's needs and the decision-making authority to get the job done. The policy features:

-

Defendants' reimbursement of expenses - $500 per day subject to $12,500 maximum (reimbursement applies day one)

-

ADA/FHA/OSHA regulatory or administrative action reimbursement - $30,000 per policy period

-

Free pre-claims assistance

-

Disciplinary proceedings reimbursement - $5,000 per proceeding

-

Definition of "Insured Person" includes temporary or leased personnel and retired personnel Predecessor firm coverage, including joint ventures

-

Worldwide coverage

-

Liberalization clause

-

Blanket waiver of subrogation provision

-

Punitive damages extension where allowable by law

-

Deductible mediation credit of 50% subject to a $12,500 maximum

-

Automatic 90-day coverage for acquired or merged entities

-

5 Year Extended Reporting Period

-

Innocent insured provision

-

Consent to settlement provision - 50/50 co-share between "Insured" and "Insurer"

-

60-day automatic extended discovery period

-

Automatic excess coverage for separately insured projects

-

Management Pack Enhancement Endorsement (Directors & Officers, Fiduciary and Employment Practices Liability Insurance Coverages)

-

High Self Insured Retention Program (Top & Drop)

Learn more by logging into Big "I" Markets and clicking on Big "I" CBIC Design Pros from the commercial products menu.

|

A computer consultant was hired to create a new computer system for a client. The client alleged the new system was not functional and corrupted their current system. The claim resulted in a $70,000 loss. A computer consultant was hired to create a new computer system for a client. The client alleged the new system was not functional and corrupted their current system. The claim resulted in a $70,000 loss.

A recruiting firm filled a position for a branch manager. Shortly after being on the job, the manager was fired by the client company. The client company sued the personnel agency because sales declined. They alleged that the manager was not properly screened to determine that he was a poor performer. The loss totaled over $50,000.

Can you afford to not secure professional liability for professional errors and omissions? You can access professional liability for categories such as:

-

Human Resource Consultant

-

Management Consultant

-

Technology Consultants

-

Translator/Interpreter Services

-

Marketing Consultant

-

Telecommunications Consultants

-

Appraiser

You can serve all these professionals and many more by accessing Philadelphia Insurance's Miscellaneous Professional Liability policy through Big "I" Markets.

"Cover-Pro" provides errors and omissions coverage to a great variety of professionals via endorsement to a basic claims-made, pay-on-behalf policy. The underwriting staff tailors each policy to address the exposures unique to each class of business. Philadelphia has additional solutions to address specific professional coverage needs of the following classes: Technology, Media, Accountants, and Temporary Staffing.

COVERAGE HIGHLIGHTS & AVAILABILITY

-

Disciplinary proceeding Defense Costs limit of $10,000 per policy period

-

Free 60-day discovery clause

-

Loss assistance hotline - two (2) free hours of legal consultation

-

Defense afforded for groundless, false or fraudulent allegations

-

Full severability of the fraud and criminal acts exclusion for all Individual Insureds; fraud and criminal acts are defended until final adjudication regarding such alleged conduct

-

Automatic Independent Contractor coverage for professional services while acting on the Insured's behalf

-

Punitive and Exemplary Damages coverage

-

Customized Pro-Pak endorsements to meet the unique coverage needs for many classes of business

LIMITS AVAILABLE

-

The liability limits available range from $100,000 limit up to $15,000,000.

-

No Filed Minimum Premiums

Miscellaneous Professional Liability coverage is underwritten by Philadelphia Insurance Company on an admitted basis (available in all states except Louisiana). Philadelphia Insurance Companies has an A.M. Best Rating 'A++' Superior. Learn more at bigimarkets.com.

|

| |

Remember that you can view the following webinars 24/7 by checking out the BIM Webinar Library. To do that log onto Big "I" Markets and click on "Publications".

-

TravPay

-

Commercial Lessor's Risk

-

Affluent Homeowners

-

Travel Insurance

-

Community Banks

-

Affluent Homeowner

-

Real Estate E&O

-

RLI Personal Umbrella

-

"Oh, by the way...Flood Sale"

-

Habitational

-

Student Housing

+++++

BIM WEBSITE TRAINING WEBINAR

For all you folks who recently registered for Big "I" Markets, remember you can participate in a webinar from the comfort of your office to help you learn how to navigate around the system. Every Thursday at 2:00 p.m. EDT we'll show you how to navigate the Big "I" Markets platform, including how to submit a quote! A recording of this webinar can be found under "Publications" after logging into Big "I" Markets.

+++++

Part 3 of 3: DocuSign Webinar Series Continues on 10/13

Digital Insurance: Meeting the Needs of the Digital Customer – Part 3 of 3

DocuSign and the Big "I" have partnered to bring you a 3-part webinar series on digital insurance.

Technology has changed the way businesses interact with their customers. Customers are on their digital devices and expect immediate service from the companies they do business with. Stay ahead of the competition by providing services the way your customers live - on digital devices.

Webinar Date: October 13, 2016 - 10:00 AM PDT ( 1:00 PM EDT)

Don't wait, register today for part three of this 3-part series and learn how other insurance agents and brokers are using DocuSign to improve workflows.

+++++

Big "I" Virtual University Webinars

Don't miss the following education opportunities provided from the Big "I" Virtual University experts that focus on topics agents need to know to make a smart start in 2016. For more information, contact national staff.

-

October 17. "First Monday LIVE!" is a free monthly webcast hosted by the VU's own Bill Wilson and guests on the first Monday of the month to discuss the wide world of insurance from seemingly non-insurance topics. Each 30-minute webisode covers "what's going on" in the news and the implications. The September broadcast is in development as subject matter is explored. Click here to learn more and register and here to access the recordings.

-

October 27. "NFIP: Change, Chaos and Confusion" In this two-hour session, David Thompson of the Florida Association of Insurance Agents teams up with Chris Heidrick of Heidrick and Company in Sanibel Island, Florida to bring you up to speed on where we were and (as best as anyone knows) where the NFIP is going. Subjects such as subsidized rates, grandfathering, refunds, surcharges, lapses, and the ever-popular robust private flood insurance market will be discussed. Click here to learn more and register.

|

STUDENT OF THE INDUSTRY PARTING SHOT

Rate Indications #2: What is a Permissible Loss Ratio?

By Paul Buse, President of Big I Advantage®

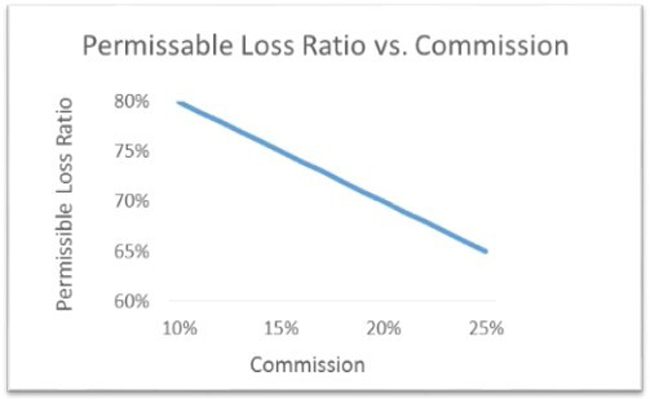

Last week we looked at Rate Indications and where they come from. The example was a book of business that had an estimated loss ratio of 70% and a Permissible Loss Ratio (PLR) of 65%. This resulted in a needed rate increase, or "Rate Indication," of about 8%. But what's the PLR and why is it important?

In the above formula the denominator (in red) is the permissible loss ratio or PLR. The math is basically saying when loss and adjusting expenses plus insurer fixed expenses (the numerator) are equal to a one (1.0) less acquisition costs, premium taxes and an insurer profit load, no rate change is needed. As usually the biggest component of variable expenses is commissions, below is the resulting impact on the PLR as commissions increase from 10% to 25%.

Click for larger version

Graph Assumptions: Fixed Expenses of 10%, Insurer Profit of 5% and Non-commission Variable Expenses of 5% (Premium taxes plus other acquisition-related)

So why is this important? Well, the higher the PLR, the lower the premium. If expenses are higher, rates charged must be higher to generate the same return. Insurers must always assess what brings the most to their value proposition for consumers. Speaking of expenses and value in the insurance equation, the figures for 2015 are in and A.M. Best Aggregates & Averages have arrived. In a week or two, we'll look at total advertising spending in 2015 and compare that to commissions.

|

BIG "I" MARKETS SALE OF THE WEEK

|

|