By Meghan Jackson, Business Development Manager for the Washington DC Territory, Chubb PRS

According to the National Retail Federation, jewelry was one of the top 10 types of gifts consumers planned to give over the holidays. This means there is a good chance your clients and prospects received jewelry as a gift this holiday season, presenting a great opportunity to ask this one important question: According to the National Retail Federation, jewelry was one of the top 10 types of gifts consumers planned to give over the holidays. This means there is a good chance your clients and prospects received jewelry as a gift this holiday season, presenting a great opportunity to ask this one important question:

Did you receive a piece of jewelry as a gift over the holidays?

As you kick off the new year, it's the perfect time to reach out to your clients and prospects and ask if they received jewelry as a holiday gift. If so, be the hero and make sure their treasured gift or purchase is adequately protected and provide them a quote with Jewelers Mutual at jewelry.bigimarkets.com.

Don't let your customers rely solely on their homeowners insurance as their jewelry may only be protected against specific causes of loss and usually up to a specified limit.

When it comes to insuring your clients' jewelry, here's why specialty jewelry insurance from Jewelers Mutual Insurance Group makes sense:

-

Jewelry is all they do and they've been doing for 105 years

-

Repair and replacement policy means the ring gets back on the finger where it belongs

-

Jewelers Mutual offers flexibility to work with the insured's trusted jeweler of choice; no need for multiple estimates

-

Claims start with a jewelry expert who knows exactly what your client needs and ends with a same-kind-and-quality jewelry piece.

The Difference Between Standalone Jewelry Insurance and a Homeowners Policy

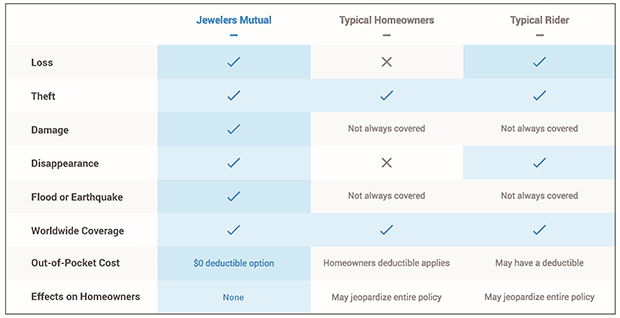

See our coverage comparison chart below for the benefits of having a standalone jewelry insurance policy versus relying on coverage through typical homeowners or renters insurance or a rider.

What does Jewelers Mutual cover? All types of jewelry - engagement rings, watches, earrings, even loose stones being set - are protected by comprehensive repair or replacement coverage that goes beyond typical homeowners or renters insurance. It protects against common perils associated with jewelry loss - like mysterious disappearance, and even includes worldwide travel.

If something should happen to your clients' jewelry, they can work with a trusted jeweler of their choice to repair or replace their piece with the same kind and quality.

For more information about Jewelers Mutual, visit Jewelry Insurance on the Big "I" Markets product listing. Coverage is available to Big "I" agents in all states.

|

SPECIAL FEATURE

Save the Date for Free Agency Risk Management Webinar on Commercial Placements

The next session in the Big "I" Professional Liability/Swiss Re Corporate Solutions quarterly webinar series will focus on commercial lines coverage placements. The next session in the Big "I" Professional Liability/Swiss Re Corporate Solutions quarterly webinar series will focus on commercial lines coverage placements.

Commercial placements have been a leading cause of insurance agents errors & omissions claims for years. If your agency has exposure to these types of coverages, you don't want to miss this webinar scheduled for Feb. 6, 2019 at 2 p.m. EST.

Our panelists will take an in-depth look at a number of different claims and answer the following: What went wrong? What was the outcome? And what could be done differently to prevent a similar type of claim at your agency?

Reserve your spot for Agency Risk Management Essentials: Commercial Lines - Back to Basics today.

If you have any questions, contact Jim Hanley at 703-706-5469.

|

Commercial Auto or Fleet

The terms "commercial vehicles" and "fleet vehicles" are often used interchangeably, and although there is some overlap in their meanings, they should not be used as replacements for one another, at least in most cases. So what are the differences between them? The terms "commercial vehicles" and "fleet vehicles" are often used interchangeably, and although there is some overlap in their meanings, they should not be used as replacements for one another, at least in most cases. So what are the differences between them?

Commercial vehicles are designed for the transporting of goods or large groups of passengers. Cargo vans are the most commonly referred to commercial vehicles, but heavy-duty trucks like the Dodge Ram HD or Ford Super Duty also fall within the commercial vehicle category. Usually commercial vehicles belong to a company or corporation and are used for business purposes.

Fleet vehicles must be owned by an organization, business or agency rather than privately owned. Fleet vehicles can be any body type small cars to the larger pickups and vans. The definition of fleet vehicles is much simpler than that of commercial vehicles, as there are no size requirements, only the requirement that they be owned by a business rather than individuals. On a more generally basis a fleet is 5 or more vehicles.

Big "I" Markets offers Commercial Auto - Monoline with three carriers (Travelers, MetLife & Progressive) from which to choose. Liability ranges from $1-$2 million. Coverages and availability vary by state and carrier.

Travelers

Travelers small commercial auto coverage provides up to 1 million dollars of liability protection and can be written on a monoline basis for classes of business that would be eligible for the Travelers Select MasterPac program. Travelers will entertain vehicles used commercially, but is NOT a market for:

-

Livery services

-

Hauling of hazardous materials

-

Truckers

-

Dump Truck operators

Coverages available but not limited to:

-

Liability - $1M

-

Broad range of deductibles

-

Ability to write multi-state exposures on one policy

-

Hired Auto Physical Damage

-

Employee Hired Auto

-

Blanket Additional Insured

-

Auto Loan Lease Gap

Travelers Select Commercial Auto is available to members in all states except AK, HI & TX.

MetLife Auto & Home Business Insurance MetLife Auto & Home Business Insurance provides dependable and hassle-free coverage to an array of small businesses in your community that use commercial autos and trucks in their daily activity and have a commercial auto fleet of up to nine vehicles. Here are just a few examples:

-

Contractors

-

Professional and Technical Services

-

Retail Businesses

-

Wholesalers and Distributors

-

Manufacturing and Local Trucking Companies

-

Delivery Services

Vehicles (Private Passenger Types and Trucks) with a gross vehicle weight of 20,000 lbs. or less and most trailers are eligible. The vehicles' operational radius (one way) can be 99 miles or less.

Coverages available include:

-

Liability Limits from $100,000 to $2 Million CSL

-

Comprehensive and Collision Deductibles of $250, $500, $1,000, $2,500 and $5,000

-

Hired Auto/Non-owned and Drive Other Car Coverage

-

Business Interruption

-

Audio, Visual and Data Electronic Equipment Coverage to $10,000

-

Tapes, Records and Discs Coverage to $200

-

Auto Loan Lease Gap

-

Loss of Use

MetLife Auto & Home Business Insurance is currently available to members in AZ, CA, CT, FL, GA, IL, IN, MN, NC, NJ, NY, OH, OR, PA, SC, TX and WA. More states will be available in the near future.

Progressive Progressive Insurance offers a wide range of commercial auto insurance programs to fit the needs of the small business operation. Whether it's for passenger autos or heavy trucks, Progressive can write the policy. We offer robust coverages for a wide variety of drivers and vehicle types, with accurate and competitive pricing that considers each risk independently. Examples of eligibility include:

-

Janitorial services

-

Social/health services

-

Retail shops

-

Religious/nonprofit organizations

-

Couriers

-

Adult/child care

-

Airport/hotel shuttles

-

Contractors

-

Landscapers and snowplowers

-

Concrete/asphalt

-

Heavy construction

-

Farming and livestock

-

Food truck vendors

-

Food delivery

-

Wholesale route distributors

Progressive offers robust coverage options such as:

-

Higher Limits - up to $2M (it is Big "I" Markets' business practice to not quote less than $100,000. This is NOT a recommendation. As the sub-producing retail agent it is incumbent upon you to work with your client to request adequate limits for their exposure.)

-

Any Auto Liability

-

Hired Auto Liability

-

Employers' Non-Ownership Liability

-

Drive Other Car

-

Roadside Assistance

-

Rental Reimbursement

Progressive is currently available to members in AZ, CA, CO, FL, ID, MD, MN, MO, MT, NY, PA, RI, SD, TN, TX and VA. More states will be available in the near future.

If you have any questions about the Commercial Auto-Monoline product, please contact Big "I" Markets Commercial Underwriter Tom Spires at tom.spires@iiaba.net or Claire McCormack at claire.mccormack@iiaba.net.

|

|

NEW Lightning Learning for January

Big "I" Virtual University

|

|

Dates: January 15, 24 & 29

Time: 11:30 - 11:50am EDT

Cost: $9.99 (includes all sessions)

Summary:

The VU's January Lightning Learning series features three 20-minute sessions dedicated to Cyber Issues and Your Independent Agency Even if you can't participate in the live sessions, you will receive a link to the on-demand recordings and can listen to them at your leisure. Register once and attend:

-

January 15 - It's a Cyber World

In this session, learn about the ever-changing and accelerating world of cybercrime. Participants will gain an understanding of the escalation of worldwide cyber threats and incursions, and drill down to the very real threats against small business owners in the independent agent distribution channel. We'll also cover potential costs , from prevention and post-breach standpoints.

-

January 24 – Cyber Hygiene as a Regulatory Requirement

In the emerging regulatory environment for cyber prevention, agents and brokers need to understand what is required of them nationally, and from the states in which they do business. Participants in this session will learn more about:

-

Gramm-Leach-Bliley

-

NY DF

-

The NAIC Model Law

-

Emerging state online privacy laws

-

January 29 - Real Cyber Resources to Get Started and Stay Prepared

Admittedly, knowing where to start on something as complex as a cyber hygiene program is key. Participants in this session will learn more about the Agents Council for Technology’s ‘Agency Cyber Guide’, and how it provides clear background, details on regulations, and resources to address cyber regulations.

Consider presenting conference style for the entire agency to benefit. Please send any questions to VU staff. Review all VU education offerings here.

Registration:

|

|

NEW Deliver World Class Claims Experience with DocuSign

Business Resources

|

NEW Commercial Lines Coverage Placements

Agency Risk Management

|

|

Dates: January 17

Time: 1:00 - 2:00pm EST

Cost: FREE

Summary:

In today's world of one click shopping and two day shipping, customer expectations have evolved - faster, easier and smarter is the new mantra. According to McKinsey, customers are increasingly ready to leave manual claims processes behind and move to a purely digital model. Are you meeting your customers' expectations? Become a truly digital insurance company by delivering a great customer experience through omni-channel onboarding and claims processing. Join this session to see how DocuSign can help you:

-

Accelerate insurer on-boarding

-

Streamline claims processes

-

Minimize fraud risks and make claims more secure

Big "I" members save 20% on DocuSign annual plans! Sign-up online at www.docusign.com/IIABA or contact brett.sutch@iiaba.net for more information.

Registration:

|

Dates: February 6

Time: 2:00 - 3:00pm EST

Cost: FREE

Summary:

The next session in the Big "I" Professional Liability/Swiss Re Corporate Solutions quarterly webinar series will focus on commercial lines coverage placements.

Commercial placements have been a leading cause of insurance agents errors & omissions claims for years. If your agency has exposure to these types of coverages, you don't want to miss this webinar scheduled for Feb. 6, 2019 at 2 p.m. EST.

Our panelists will take an in-depth look at a number of different claims and answer the following: What went wrong? What was the outcome? And what could be done differently to prevent a similar type of claim at your agency?

Reserve your spot for Agency Risk Management Essentials: Commercial Lines - Back to Basics today.

If you have any questions, contact Jim Hanley at 703-706-5469.

Registration:

|

|

NEW 3 Keys to Getting the Named Insured Correct

Big "I" Virtual University

|

NEW Five Contractor Coverage Concepts Every Agent MUST Understand

Big "I" Virtual University

|

|

Next Date: Wednesday, February 6 (occurs monthly)

Time: 1:00 - 2:00pm EST

Cost: $179 nonmembers / $79 members (includes live presentation, recording and written transcript)

Summary:

Before any claim is paid, status as an “insured” must exist. Is the person or entity suffering or causing loss, injury or damage an insured? If the answer is “no,” there is no need to go any further. If “insured” status does not exist, all your hard work is wasted; no one will ever find out how good you are at designing coverage – because you messed up at the beginning.

If you mess this up, you will have a ticked off insured and maybe an E&O claim you never expected. You have to get this one detail – the named insured – correct.

Participants in this class will be able to:

-

Identify improperly named insureds;

-

Understand the amount of protection extended to an insured;

-

Describe the technical difference between a “DBA” and a “TA";

-

Explain why one “person” can't do business/trade as another “person"; and

-

Properly manage multiple named insureds.

CE credits are available in select states. Check web page for details. Please send any questions to VU staff. Review all VU education offerings here.

Registration:

|

Next Date: Wednesday, February 13 (occurs monthly)

Time: 1:00 - 3:00pm EST

Cost: $179 nonmembers / $79 members (includes live presentation, recording, and written transcript)

Summary:

Contractor risks are unique regarding their risk profile, exposures and coverage needs. Agents must understand these unique risks, exposures and coverages to properly manage their contractor clients.

This session focuses on five of the most common contractor risk exposures:

-

Contractual Risk Transfer

-

Properly Extending Insured Status

-

Business Auto Issues

-

Misuse of the Absolute Pollution Exclusion

-

Professional and Pollution Exposures Faced by Contractors

A lot of material is covered in this fast-moving, two-hour session. Agents will be better prepared to analyze the risks presented by their contractor clients and know how to properly respond to their coverage needs and claim questions.

All 2-hour Big “I" Virtual University webinars include access to the live session, a link to the post-event on-demand recording available to you 24/7, and a transcript, a valuable and value-added reference tool.

CE credits are available in select states. Check web page for details. Please send any questions to VU staff. Review all VU education offerings here.

Registration:

|

|

Be one of the first five with the correct answers and win a $5 gift card (Starbucks, Dunkin' Donuts, Baskin Robbins, or Krispy Kreme).

Don't forget to answer the Tie Breaker!

1. On this date in 1861 Elisha Otis received Patent No. 31,128 for a device that protected passengers from serious injury or death. What was the name of the device?

2. According to the National Retail Federation what percentage of 18-24 year old shoppers planned to give Jewelry this past holiday season?

3. What is the gross vehicle weight limit for Commecial Auto through MetLife?

TIE BREAKER

TB - A New Years Eve truck fire caused the Lexington KY, police to post expression of their grief on social media even though no one was injured. What cargo was destroyed in the fire?

|

BIG "I" MARKETS SALE OF THE WEEK

|

|

|

|

|

|

|