SPECIAL FEATURE

Coalition Update: 13 More States Added to Admitted Lineup & Admitted Enhanced in Colorado & Maryland.

States Newly Added to Admitted Lineup: Alabama, Connecticut, District of Columbia, Indiana, Iowa, Mississippi, Nebraska, Nevada, New Hampshire, New Mexico, South Carolina, South Dakota, and West Virginia. States Newly Added to Admitted Lineup: Alabama, Connecticut, District of Columbia, Indiana, Iowa, Mississippi, Nebraska, Nevada, New Hampshire, New Mexico, South Carolina, South Dakota, and West Virginia.

Coalition's admitted cyber product is now available in 31 states: AL, AZ, CA, CO, CT, DC, DE, IA, IL, IN, MD, MN, MO, MS, NC, NE, NH, NJ, NM, NV, NY, OR, PA, RI, SC, SD, TN, TX, UT, WI & WV.

Technology Errors & Omission coverage is not currently available in the admitted policy in any state.

The following endorsements were approved in the admitted policy for Colorado and Maryland and are available in all admitted states except Missouri and Texas:

-

Breach Response Separate Limits

-

Reputational Harm Loss

-

Service Fraud

-

Criminal Reward Coverage

-

Court Attendance Costs

-

GDPR Enhancement

How do I obtain an Admitted Quote?

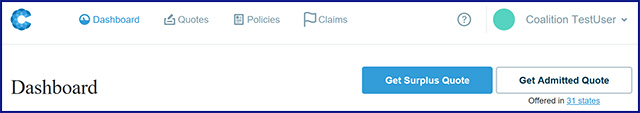

The process is nearly identical to obtaining a surplus lines quote. You will now notice a new button labeled "Get Admitted Quote" on the upper right-hand corner of your Coalition Dashboard where the "Get Quote" button used to be:

Just click on this button and you'll be taken to an identical set of questions used to obtain an admitted quote. If the risk falls outside the admitted parameters, you will be given the option to continue as a surplus lines quote.

Reach out to Carla McGee, your dedicated cyber liability program manager, at 800-221-7917, ext. 5495 if you have any questions or to walk through a quote.

|

Indoor Environmental Loss Exposures in Condos, Schools, Hospitality, and Other Commercial Properties

By Aaron Millonzi, Knowledge Coordinator and David Dybdahl, President & CEO - American Risk Management Resources Network, LLC

Are your clients covered? Are your clients covered?

Probably not!

What comes to mind when you imagine a property that needs to purchase pollution insurance? It's probably something like a chemical mix and blend facility, a manufacturing plant, or maybe a landfill. Odds are it's not a standard condominium or apartment building, an elementary school, or commercial office building that houses an insurance agency, an investment brokerage firm, and a dental office. For many, the thought that something as innocent as a school or as common as a commercial office building has environmental loss exposures is laughable. The truth is it's not as far-fetched as it may seem. In fact, every property or location carries some risk of a contamination loss and therefore needs specially designed environmental insurance coverage to protect them against these loss exposures, even the most unsuspecting ones.

Really Important Things Every Insurance Agent Needs to Know

-

60% of all property insurance losses involve water intrusion indoors.

-

Moist drywall will grow mold (fungi) at room temperature within 3 days.

-

Drinking water on carpeting will morph into bacteria contaminated Category 3 water within 3 days.

-

Every drop of water in a drainpipe is Category 3 water because of the bacteria in it.

-

Property insurance policies have sublimits (completely inadequate) for fungi or bacteria.

-

The average commercial property mold remediation without business interruption expense is $250,000; the average sublimit is $15,000.

-

Mold is an allergen; bacteria contamination can be fatal.

-

GL policies usually have complete exclusions for losses in any way associated with fungi or bacteria contaminants.

-

Environmental insurance was originally designed for outdoor use, not indoor.

What are the environmental loss exposures that condo buildings, schools, and office buildings possess and why do they need environmental insurance to cover them? These properties can have a wide array of pollution loss exposures, from exposures to asbestos and lead, to a leaking underground storage tank; however, the most common pollution loss exposures for these types of properties revolve around indoor air quality. The driver of most indoor contamination losses is water intrusion in a building. All structures are prone to mold or fungi claims and bacteria-related losses. But why do water losses in building create environmental loss exposures which now require the purchase of environmental insurance? The answer to this question is a little more complicated.

The gist of it is pollution exclusions and contaminant-specific exclusions such as fungi or bacteria exclusions on standard commercial property and liability insurance policies. These exclusions drive the need for environmental insurance. In addition to these exclusions, there are also various sublimits for things like pollutant cleanup and mold- and bacteria-related losses. These exclusions and sublimits render standard property and liability insurance policies inadequate or completely ineffective in terms of providing coverage for the contamination loss exposures faced by many commercial properties, education facilities, and large residential buildings. This in turn requires the purchase of environmental insurance products designed for indoor use to fill the coverage gaps created by the exclusions and sublimits in both property and liability insurance policies.

While condo buildings, schools, and commercial office buildings can be affected by pollution exclusions or sublimits, it's the contaminant-specific exclusions, particularly fungi or bacteria exclusions and sublimits, that really do them in. Sixty (60) percent of commercial property insurance losses involve water damage within a structure, and that's not including flood losses. Moisture on drywall can result in mold growth in as little as 72 hours, even sooner in the right conditions. As soon as the m-word is involved in a property loss, it triggers the fungus/mold/bacteria exclusion on the property policy; in many cases, the policy has an additional, limited coverage for fungus/mold/bacteria-related losses, but it comes with a significant sublimit. This sublimit can vary, but is often around $15,000. It helps to know that an average mold remediation job on a commercial building is $250,000. That's a pretty big gap in coverage - something many property owners are shocked to discover when they have a mold or category 3 water loss and expect to be fully covered under their commercial property policy.

Mold claims are not new. The good news for property owners is that in the past, these claims have been paid by claim adjusters who were not familiar with the actual workings of mold exclusions as standard water intrusion claims and therefore not subject to significant sublimits. The bad news is the tide is changing. It's clear that more and more of more claims are being excluded on standard property insurance policies. We know this because mold claims are being paid on environmental site policies. In fact, it was revealed by a panel of insurance company executives at the Society of Environmental Insurance Professionals conference in June of 2017 that mold claims had eclipsed every other type of loss as the number one source of claims on environmental impairment liability (EIL) policies. As property claims adjusters get smarter and start pulling the trigger on fungus/mold/bacteria exclusions and sublimits, this will only continue to drive the need for environmental insurance to cover commercial property owners for their fungus/mold/bacteria exposures.

In the early 2000's there was a "toxic mold" media frenzy which was the impetus of the new ever present fungi or bacteria exclusions. Today there's another "pollutant" that's been making headlines recently: bacteria.

Legionella bacteria has become well-known, because of Legionnaires' disease outbreaks. Legionnaires' disease is a is a very serious type of pneumonia (lung infection) caused by Legionella bacteria. In nature, Legionella bacteria exists in things like rivers and lakes and usually does not cause illness. This type of bacteria creates a health risk when it aerosolizes into tiny water droplets in the air that people breathe in. In the built environment Legionnaires disease is most commonly caused from a water source that is not properly maintained. Some common sources are HVAC cooling towers, hot tubs, decorative fountains and falling water features, hot water tanks and heaters, and plumbing systems. Almost every commercial building, school, hotel, and condo building has one or more of these potential sources of bacteria contamination. Therefore, these facilities are at risk for spreading Legionella bacteria and making people sick. These outbreaks commonly result in a bodily injury claim for seven figure damages by those affected or by their family members and almost always require legal defense.

In these situations, most businesses turn to their liability insurance policy for defense and payment of damages, the most common policy being the Commercial General Liability (CGL) policy. Unfortunately, like standard property insurance policies, most CGL policies contain a pollution exclusion as well as additional contaminant-specific exclusions such as a fungi or bacteria exclusions. Unlike most property insurance policies, the majority of CGL policies do not have sublimits for fungi, mold or bacteria-related losses. In fact, these exclusions not only preclude coverage for damages, but they also relieve the insurance company from having to provide legal defense on behalf of the insured. This leaves the business or property owner completely on their own to defend themselves and pay any claims for bodily injury or wrongful death. This has become a common occurrence with many of the Legionnaires' disease outbreaks over the past few years.

Alas, there is environmental insurance designed to cover these very loss exposures. Well-designed programs provide both liability coverage for claims brought against the insured and cleanup and remediation of pollutants, including mold and bacteria losses. One product in particular is ARMR HPR™. It combines a full-service site pollution liability policy with built-in boots-on-the-ground loss control; coverage is specifically tailored to the indoor environment and it affordably priced, typically at 10% of the property insurance premium. Visit our page, Pollution Insurance: Contractors-Commercial Properties-USTs-All Other, on Big "I" Markets to submit a risk and learn more!

The main takeaway is properties like commercial office buildings, schools, hotels, and condo buildings all have pollution loss exposures and need to purchase environmental insurance to adequately cover themselves for these risks. Their greatest pollution loss exposures involve indoor air quality issues such as mold growth and bacteria exposure to the occupants. Pollution exclusions and pollutant-specific exclusions like fungi or bacteria exclusions on standard property and liability insurance policies render these policies inadequate or completely ineffective at providing coverage for these loss exposures. It's important to understand this, communicate it to insureds, and encourage them to purchase environmental insurance that is designed to provide coverage for the pollution loss exposures they face.

David Dybdahl, an environmental insurance veteran and expert witness, says it best: "Agents that leave their customers uninformed about the far-reaching effects of the mold or bacteria sublimits are in for a rough ride when their clients realize the typical $10,000 fungi and bacteria sublimit applies to their $600,000 water loss. The ARMR HPR™ product line is easy to use - we can get pricing indications out the door based simply on the property insurance schedule."

|

|

VU Webinars and Lightning Learning

Virtual University

|

WEBINARS - Two-hours with CE in select states.

View the complete calendar, registration links and see what states have CE approval online. Registration includes live webinar, on-demand recording and a transcript.

LIGHTNING LEARNING - Twenty minutes each with a focus on Did the Underwriter Follow the Law?

-

August 6 - 11:30 a.m. ET - Underwriting Period: How Long Does a Carrier Have to Review a New Policy?

-

August 13 - 11:30 a.m. ET - Mid-Term Cancellations: When is a Carrier Allowed to Cancel a Policy Before the End of the Policy Period

-

August 20 -11:30 a.m. ET - Conditional Renewals: When Does the Carrier Have to Give Renewal Information?

Register once for the monthly Lightning Learning package and receive all sessions for one low price. Registration includes live presentations and on-demand recordings.

VU Webinar and Lightning Learning questions can be sent to VU staff. The 2019 calendar and all links are available here.

|

|

|

Prizes will be to the first response with the correct answers and then four selected at random from all received by 6p.m. EDT on Wednesday. Win a $5 gift card (Starbucks, Dunkin' Donuts, Baskin Robbins, or Krispy Kreme).

Don't forget to answer the Tie Breaker!

1. Category 3 water is also known by what colorful name?

2. The House of Burgesses formed in Virginia on this day in 1614. What is significant about that?

3. On December 28, 2012 China declared children must do what for their elderly parents?

TIE BREAKER

TB - Silent film actor Bill Turpin took out a $25,000 insurance policy in case what happened to his eyes?

|

BIG "I" MARKETS SALE OF THE WEEK

|

|

|

|

|

|

|