+++++

"Data Breach, The New Wild West? Cyber Risk Exposures and Insurance"

July 15, 2015; 1:00 - 4:00 p.m. Eastern Time

$79 - Click here to register

In 2014 the number of data breaches was widely publicized including online fraud, identity theft and business data breaches. Criminal hackers are no longer 'thrill seekers', but professional computer experts and criminals mostly located outside of the United States. Very few insurance producers have knowledge of the problems and possible solutions and this can leave them unable to discuss what steps (including risk management and insurance coverages) need to be pursued. This webinar will explain first and third party exposures to various cyber risks, the lack of insurance coverages in current CGL and property policies and the emerging markets for this coverage.

Other upcoming VU webinars include Beyond the Basics: Emerging Issues Personal Lines Issues and Certificates of Insurance - 2015 Edition. VU webinar questions can be sent to bestpractices@iiaba.net.

+++++

Remember that you can view the following webinars 24/7 by checking out the BIM Webinar Library. To do that log onto Big "I" Markets and click on "Publications".

- Personal Liability Trends - Fireman's Fund

- TravPay

- Commercial Lessor's Risk

- Affluent Homeowners

- Travelers Select Products (series)

- Travel Insurance

- Community Banks

- XS Flood

- Real Estate E&O

- RLI Personal Umbrella

- Affluent Homeowner

- "Oh, by the way...Flood Sale"

- Habitational

- Non-standard Homeowner

- Student Housing

+++++

BIM WEBSITE TRAINING WEBINAR

For all you folks who recently registered for Big "I" Markets, remember you can participate in a webinar from the comfort of your office to help you learn how to navigate around the system. Every Thursday at 2:00 p.m. EDT we'll show you how to navigate the Big "I" Markets platform, including how to submit a quote! A recording of this webinar can be found under "Publications" after logging into Big "I" Markets.

________________________________________

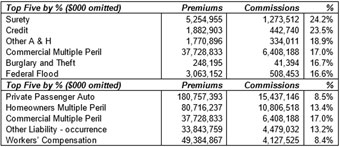

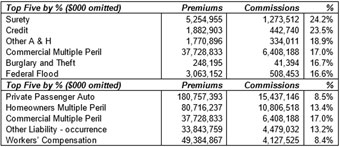

What "Line of Business" Pays the Most Commission?

By Paul Buse, President of Big I Advantage

What "Line of Business" (or LOB) pays the most commission? By that you have to define "most." That is, is "Most" the "rate of commission" or "dollars?" Fortunately, the answer to both of these questions are simple to find. The United States insurance industry, as regulated by our state insurance departments, is one of the most transparent industries anywhere…in the world. You can see the answer below on either the basis of the highest percentage or the most dollars paid.

Click Graph for larger version

Source: A.M. Best Aggregates and Averages

Click Graph for larger version

Source: A.M. Best Aggregates and Averages

As a student of insurance, you may wonder how is it these figures are so available? After all, can you get that figure for the commission paid on all Volkswagens or Fords? With our industry you would know it for Jetta vs. Escape. Why? Each year for over 100 years, insurers have filed increasingly detailed Annual Statements (also known as "Convention Blanks" or "Yellow Books") with their designated state authority. So specific, in fact, that those that fill them out used to call the "Yellow Peril" for the potential to make mistakes with the exacting rules. These statements are required to be on exact forms because regulators are very interested in the financial health of insurers and the profitability of the insurance sold. The commission figures above were taken from what is called the Insurance Expense Exhibit (or IEE) and it is but one many fields monitored on 35 LOBs.

Did you notice I "snuck in" a sixth LOB? Federal Flood. I did that to make the point that if you are not getting a competitive commission, you should go to www.iiaba.net/flood. From there you can contact Selective Insurance Company, IIABA's endorsed provider of federal flood. They are the ONLY insurer that provides direct support of the lobbying efforts on your behalf. You should support them and their systems and support will make you very happy you did.

________________________________________

Be one of the first five with the correct answers and win an envy-inspiring TFT Trivia T-shirt. Don't forget to answer the Tie Breaker!

Ed James (FL), Lisa Gammill (MS), George Goodman (NY), Kathy King (MD), & Jody Shellberg (IA)

1. According to the Selective flood article referenced above how much was the average flood claim from 2008-2012? - $42,000

2. What breed of dog originated in Germany by a tax collector who needed a guard dog for protection? - DOBERMANN (or Dobermann Pincsher)

3. The Government Printing Office was established this day (June 23) in 1860; what other U.S. institution (still on the job) was created on the very same day? - SECRET SERVICE

TIE BREAKER

The dog days of summer have nothing to do with dogs. From where does the term originate? - FROM SIRIUS (The Dog Star) RISING WITH THE SUN DURING THE HOTTEST DAYS OF SUMMER

________________________________________

Here are the top three items that got BIM agents clicking from our last edition... see what you missed!

-

Selective - Inland Flooding Risk

-

Certificates of Insurance - 2015 Edition

-

Office Pac - Popular Options

________________________________________

This hurricane season is expected to be below average with only 6-11 named storms and only 3-6 of them becoming hurricanes, but that doesn't mean it's not dangerous. In 1992 there were only seven named storms but one of those was Hurricane Andrew, which reached Category 5 status before devastating south Florida.

This hurricane season is expected to be below average with only 6-11 named storms and only 3-6 of them becoming hurricanes, but that doesn't mean it's not dangerous. In 1992 there were only seven named storms but one of those was Hurricane Andrew, which reached Category 5 status before devastating south Florida. InVEST, the insurance industry's premier classroom-to-career education program has launched a new website, www.investprogram.org, and a new interactive eBook. All resources continue to be free.

InVEST, the insurance industry's premier classroom-to-career education program has launched a new website, www.investprogram.org, and a new interactive eBook. All resources continue to be free. The International Space Station (ISS) is the largest artificial body in orbit. The first components were launched in 1998 and assemble in space. It has been continually occupied since November 2, 2000 with a maximum crew of 6. It is 239 feet long and 356 feet wide, mostly solar panels, and consists of two (Russian and American) linked segments. The modular design consists of 24 laboratories, airlocks, docking ports cargo bays, nodes, connecting adaptors, living quarters, and a cupola. There are also multiple solar arrays, heat radiators, external storage, remote controlled arms, and even a two armed robot named Dextre for making external repairs. The United States and Russia have committed to staying in the station to 2024. The Russians want to create a new station using modules from their section as the base.

The International Space Station (ISS) is the largest artificial body in orbit. The first components were launched in 1998 and assemble in space. It has been continually occupied since November 2, 2000 with a maximum crew of 6. It is 239 feet long and 356 feet wide, mostly solar panels, and consists of two (Russian and American) linked segments. The modular design consists of 24 laboratories, airlocks, docking ports cargo bays, nodes, connecting adaptors, living quarters, and a cupola. There are also multiple solar arrays, heat radiators, external storage, remote controlled arms, and even a two armed robot named Dextre for making external repairs. The United States and Russia have committed to staying in the station to 2024. The Russians want to create a new station using modules from their section as the base.