In our Personal Umbrella Mythbusting series, we've busted 4 myths so far:

|

Myth #1: |

A personal umbrella is something agents only need to offer to wealthy customers. |

|

Myth #2: |

Millions of dollars in liability coverage must be really expensive. |

|

Myth #3: |

You can't obtain an affordable umbrella for a police officer, doctor, pro athlete, or politician. |

|

Myth #4: |

You have to have a good driving record to have an umbrella. |

Now for more mythbusting… Now for more mythbusting…

MYTH: It's a lot more work to get an umbrella for an elderly driver.

TRUTH: Elderly folks are often as easy to quote as any other customer.

Considering the size of the "Greatest Generation" (those born 1901-1945, and currently considered elderly) and the "Baby Boomer Generation" (those born 1946-1964, who will be elderly soon enough), wise insurers are recognizing and preparing for the fact that they'll be insuring a significantly increased number of elderly drivers. It's already getting easier for agents.

While most umbrella carriers do have additional underwriting guidelines that apply to elderly drivers, they're not so restrictive as to prevent you from obtaining a quote quickly. Similar to youthful drivers, elderly drivers may be required to carry higher underlying limits, or may not be allowed the same number of accidents as someone 20 years younger. Alternately, there may be a charge for elderly driver incidents. However, gone are the days of supplemental medical forms and categorically denying coverage based on age alone…both of which probably seem preposterous to Generation Y agents!

It's important to note that there's variation among insurers as to what makes a driver "elderly." With some companies it's being age 80 or older. With others it may be as low as 65 (a little too close for comfort, some baby boomers would argue). If you're quoting someone who's a little older, remember that they may not be considered elderly with every carrier, and so rates and underwriting may vary significantly.

As an IIABA member, you have access to two highly-rated personal umbrella carriers. RLI Insurance is IIABA's endorsed personal umbrella carrier, with broad underwriting guidelines and a self-underwriting application. Anderson & Murison is IIABA's alternative umbrella market, available when a customer won't qualify with RLI. Access both at www.bigimarkets.com or www.iiaba.net/umbrella.

|

By Elif Wisecup, Director of Marketing and Big I Advantage® Publications By Elif Wisecup, Director of Marketing and Big I Advantage® Publications

Time to watch your mailbox for the latest edition of the Big I Advantage Newsletter!

Click here to preview the newsletter, which features updates and articles from all Big I Advantage areas. The cover story penned by Big I Advantage president Paul Buse highlights a series of "missions" you can complete to ensure you are taking advantage of all the member benefits available to you through Big I Advantage.

To learn more about any of the programs highlighted in the newsletter, visit www.iiaba.net and click on "Products."

|

Climate experts at the National Oceanic and Atmospheric Administration (NOAA) continue to predict active Atlantic hurricane seasons in the coming years. We could experience a number of named storms each year, several of which may have the potential to become major hurricanes. These predictions reinforce the need for boaters in hurricane-prone regions to have preparation plans in place. Climate experts at the National Oceanic and Atmospheric Administration (NOAA) continue to predict active Atlantic hurricane seasons in the coming years. We could experience a number of named storms each year, several of which may have the potential to become major hurricanes. These predictions reinforce the need for boaters in hurricane-prone regions to have preparation plans in place.

Boat owners and the marine community should take proactive measures to minimize the potential for injuries and damage to their boats and other property. Chubb Recreational Marine Insurance® is pleased to offer its list of important tips to help recreational boaters protect their vessels as well as other property on board during the hurricane season. Learn what precautions boaters can take to prepare and safeguard their vessels this season by clicking here. Please feel free to download and review the flyer with your clients.

Remember, key factors in protecting your boat from a hurricane or any severe storm are planning, preparation and timely action. Also critical is having the proper insurance coverage in place, and understanding your policy and duties as a boat owner. Most Chubb policies offer Hurricane Haul-out coverage included at no additional charge. Chubb Recreational Marine has been one of the nation's leading providers of yacht and boat insurance for decades, and we offer an impressive array of policies for a wide range of pleasure craft. We serve the entire spectrum of boat owners - from those with small runabouts and cruisers to the largest mega yachts. The Yachtsman®/Boatsman® Policy provides all-risk protection for both pleasure boats and yachts, including select occasional charter opportunities, along with many unique benefits and features.

For more information on Chubb Recreational Marine products, log into Big "I" Markets.

|

Remember that you can view the following webinars 24/7 by checking out the BIM Webinar Library. To do that log onto Big "I" Markets and click on "Publications".

-

TravPay

-

Commercial Lessor's Risk

-

Affluent Homeowners

-

Travelers Select Products (series)

-

Travel Insurance

-

Community Banks

-

Affluent Homeowner

-

Real Estate E&O

-

RLI Personal Umbrella

-

"Oh, by the way...Flood Sale"

-

Habitational

-

Student Housing

+++++

BIM WEBSITE TRAINING WEBINAR

For all you folks who recently registered for Big "I" Markets, remember you can participate in a webinar from the comfort of your office to help you learn how to navigate around the system. Every Thursday at 2:00 p.m. EDT we'll show you how to navigate the Big "I" Markets platform, including how to submit a quote! A recording of this webinar can be found under "Publications" after logging into Big "I" Markets.

+++++

Big "I" Virtual University Webinars

Don't miss the following education opportunities provided from the Big "I" Virtual University experts that focus on topics agents need to know to make a smart start in 2016. For more information, contact national staff.

-

July 20. "Fixing Personal Lines Coverage Gaps" Through scores of real-life claims examples and court cases, this program examines common coverage gaps found in many personal lines policies and addresses the remedies for such gaps in the form of insurance products or risk management techniques. CE credit available for attendees in CT, ID, KS, MI, NJ, ND, WA, WY. Click here to learn more and register.

-

August 1. "First Monday LIVE!" is a free monthly webcast hosted by the VU's own Bill Wilson and guests on the first Monday of the month to discuss the wide world of insurance from seemingly non-insurance topics. Each 30-minute webisode covers "what's going on" in the news and the implications. The August broadcast is in development as subject matter is explored. Click here to learn more and register and here to access the recordings.

-

August 23. "Fixing Commercial Lines Coverage Gaps" Through scores of real-life claims examples and court cases, this program examines common coverage gaps found in many commercial lines policies and addresses the remedies for such gaps in the form of insurance products or risk management techniques CE credit available for attendees in AZ, CT, ID, MI, NJ, ND, WA, WY. Click here to learn more and to register.

|

STUDENT OF THE INDUSTRY PARTING SHOT

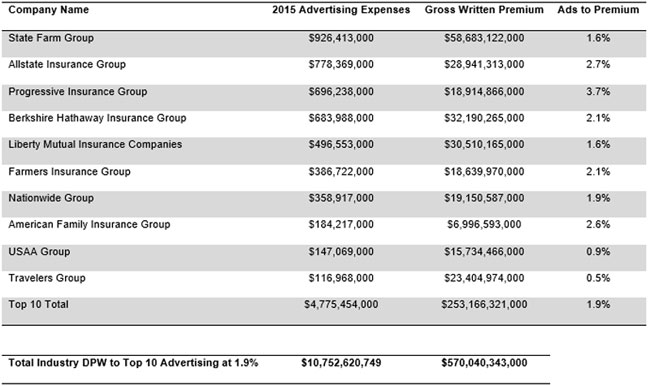

Insurer Advertising Spending: 800 Pound Gorilla?

By Paul Buse, President of Big I Advantage®

One would be hard pressed to make it through a single 30-minute program without seeing a pharmaceutical advertisement on television these days. OK, I'm older than some of you and perhaps the nightly news is a biased sample compared to Game of Thrones, but the idea is of interest as insurers also show up with frequency in advertising.

A search of the Internet tells me that estimates are that pharmaceutical companies spent about $5 billion in advertising in 2015. Other searches reveal estimates of total expenditures of all kinds of advertising in 2015 are at about $180 billion. That means pharma represents about 2.75% of total advertising expenditures. As students of the industry you know, "we don't have to estimate." With the property and casualty insurance industry, WE KNOW. Insurers all have to report in their annual "Yellow Books" to regulators how much they spend.

Below is the data on the top 10 insurer advertisers by group. Just the top 10 essentially equals pharmaceuticals in spending, so I think that makes insurers an 800-pound gorilla. If you project the average of the Top 10 to the P&C Industry as a whole, the figure is over $10 billion. Obviously smaller and regional insurers do not spend at rates that GEICO or USAA do, but all totaled, it is clear the outsized impact on advertising paid-for entertainment the P&C insurers provide.

Click for larger version

Source: A.M. Best Aggregates and Averages

|

Be one of the first five with the correct answers and win an envy-inspiring TFT Trivia T-shirt or choose a $5 gift card (Starbucks, Dunkin' Donuts, Baskin Robbins, or Krispy Kreme).

Don't forget to answer the Tie Breaker!

Congratulations to this week's winners - Ed James (FL), Linda Lyons (NC), Lisa Gammil (MS), Ann Roberts (WA) & Allen Burstein (CT).

1. What famous comic, born on this day (7/12) in 1908, got the nickname Mr. Television? - MILTON BERLE

2. From where did we get the word hurricane? - MAYAN GOD HURAKAN

3. What is the most popular flavor of ice cream? - VANILLA

TIE BREAKER

Between El Niño and La Niña, which is warmer? - EL NIÑO

|

BIG "I" MARKETS SALE OF THE WEEK

|

|